- Juniorstocks.com

- Posts

- Ukraine Locks In Western Defense Pact, Small Caps Surge, Holy Terminals in the Vatican and Fast Food Titans Sizzle: From Pot to Fryer, the Heat Is On!

Ukraine Locks In Western Defense Pact, Small Caps Surge, Holy Terminals in the Vatican and Fast Food Titans Sizzle: From Pot to Fryer, the Heat Is On!

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

U.S.-Ukraine Critical Minerals Pact: The April 30, 2025 agreement gives the U.S. preferential access to Ukraine’s vast lithium, graphite, titanium, and rare earth reserves—critical for EVs, defense, and energy—in exchange for reconstruction investments, positioning Ukraine as a key strategic supplier in the West’s mineral supply chain.

Challenges to Access and Extraction: Roughly 40% of Ukraine’s mineral wealth lies in Russian-occupied territories, and its damaged infrastructure complicates mining operations. Despite this, Ukraine’s mineral assets could support both U.S. and EU ambitions to reduce reliance on China and Russia.

Antimony Still Missing from the Puzzle: Ukraine’s mineral bounty doesn’t include antimony—a crucial input for defense tech and semiconductors. To help close this gap, Military Metals Corp (MILIF) is pushing forward antimony-focused projects in Slovakia, Canada, and the U.S., offering Western-friendly supply options outside China and Russia.

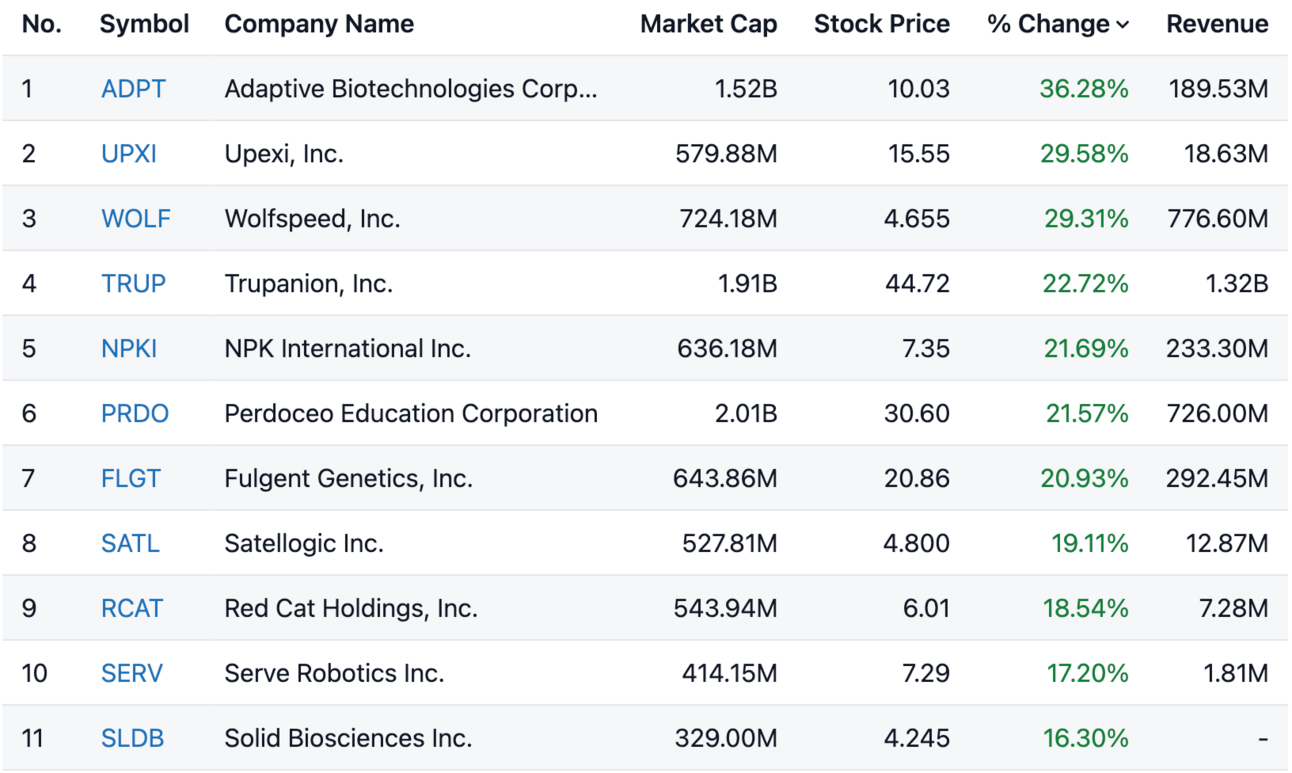

Small Cap Stocks On the Move: Top Gainers Friday

From biotech breakthroughs to crypto bets and short squeezes—here’s why these under-the-radar stocks just made a big leap.

Highest Percentage Increase Change for Small Cap Stocks Today.

Adaptive Biotechnologies Corporation (ADPT)

Shares surged nearly 37% after a strong Q1 2025 earnings report, with revenue up 25% year-over-year and significant growth in their MRD segment, leading to raised full-year guidance.Upexi, Inc. (UPXI)

Stock soared following the announcement of plans to raise $100 million to build a treasury of Solana tokens, aligning with a crypto investment strategy similar to that of MicroStrategy.Wolfspeed, Inc. (WOLF)

The stock experienced a significant increase due to a short squeeze, as investors closed out bearish positions amid optimism about new leadership and potential government funding.Trupanion, Inc. (TRUP)

Shares rose after reporting a 16% year-over-year increase in subscription revenue for Q1 2025, along with improved retention rates and operational efficiencies.NPK International Inc. (NPKI)

The company raised its full-year revenue guidance to $252 million amid strong Q1 results, driven by continued demand in utility and infrastructure markets.Perdoceo Education Corporation (PRDO)

Stock climbed after Q1 2025 earnings exceeded expectations, with revenue up 26.6% year-over-year, bolstered by acquisitions and high student retention rates.Fulgent Genetics, Inc. (FLGT)

Shares increased following Q1 2025 earnings that beat expectations, with a 16% growth in core revenue and reaffirmed full-year guidance.Satellogic Inc. (SATL)

The stock rose significantly after securing a multi-year contract under NASA's $476 million Commercial SmallSat Data Acquisition Program.Red Cat Holdings, Inc. (RCAT)

Shares gained amid bullish trends and increased investor interest in drone technology, despite recent fluctuations.Serve Robotics Inc. (SERV)

Stock price increased due to the company's expanding robotics fleet and positive long-term growth prospects in the autonomous delivery sector.

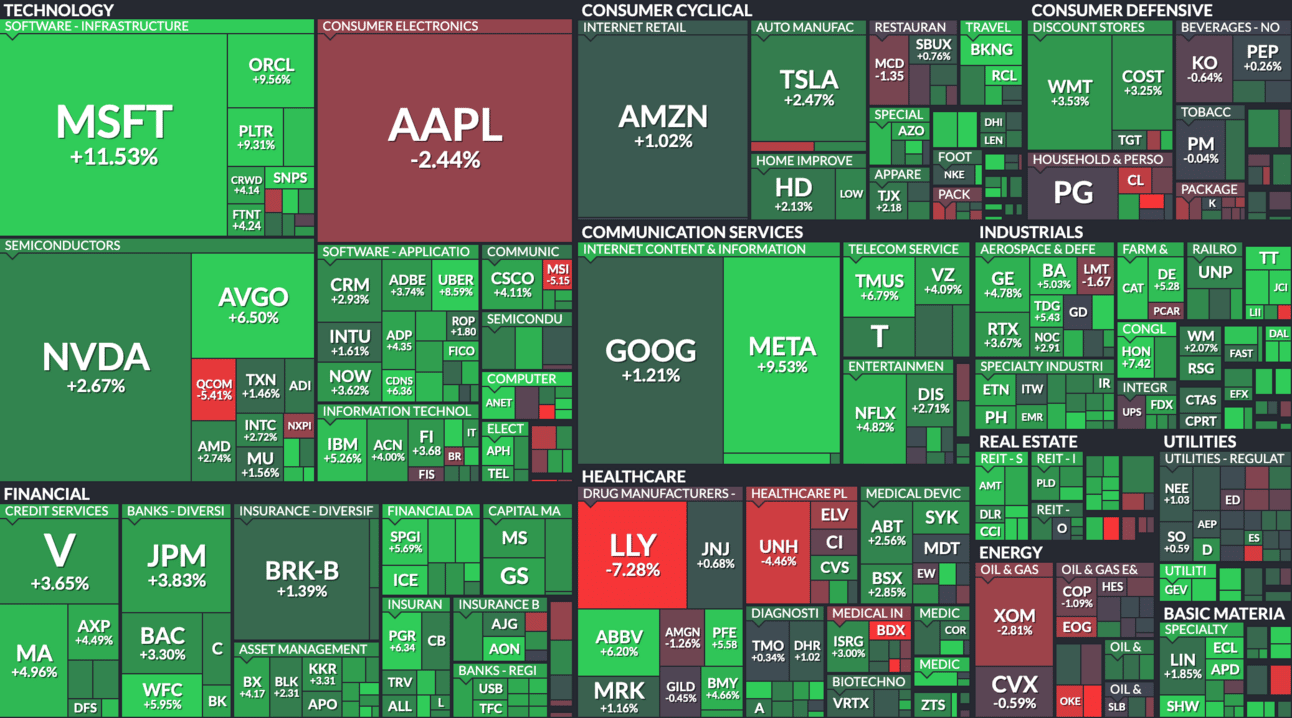

Market Snapshot Today:

📈 Market Rally Driven by Tech Giants and Tariff Optimism

Microsoft (MSFT) and Meta Platforms (META) led the market surge with impressive earnings reports. Microsoft's stock jumped 7.6% due to robust cloud computing and AI-driven revenue, while Meta rose 4.2% on strong digital ad sales and user growth. Their performance contributed to the S&P 500's eighth consecutive day of gains, marking its best streak since November 2020 .

Investor sentiment improved as President Trump paused certain tariffs for 90 days, signaling potential progress in U.S.-China trade negotiations. This development alleviated some trade-related anxieties, further propelling the market upward .

📉 Tariff Concerns Weigh on Apple and Amazon

Apple (AAPL) reported earnings that exceeded expectations; however, the stock declined due to warnings about nearly $900 million in potential tariff-related costs. The uncertainty surrounding future tariffs, especially in the semiconductor sector, has made investors cautious .

Amazon (AMZN) also delivered strong earnings but issued a cautious outlook, citing concerns over consumer spending and global trade tensions. This tempered investor enthusiasm, leading to a modest stock movement .

🔄 Broader Economic Indicators Show Mixed Signals

Economic data presented a mixed picture: while jobless claims rose more than expected, indicating potential labor market softness, manufacturing activity showed slight improvement. These conflicting signals have kept investors on edge regarding the overall economic trajectory .

The Federal Reserve's upcoming meeting is highly anticipated, with market participants hopeful for indications of potential interest rate cuts in response to the evolving economic landscape .

All data current as of 1pm EST 05/02/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |