- Juniorstocks.com

- Posts

- Why is Ashley Zumwalt-Forbes the Name to Watch in Critical Minerals, Can Bitcoin Return to New Highs and Private Equity Floods into Defense

Why is Ashley Zumwalt-Forbes the Name to Watch in Critical Minerals, Can Bitcoin Return to New Highs and Private Equity Floods into Defense

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Ashley Zumwalt-Forbes is emerging as a pivotal voice in the U.S. critical minerals space, using her unique blend of policy insight, capital market acumen, and project experience to guide industry leaders through defense-linked opportunities most overlook—like the billions earmarked for mineral stockpiling in the $150B U.S. defense package.

Her global perspective sets her apart, as shown by her analysis of Australia’s A$1.8B critical minerals initiative—where she asks the hard questions about stockpiling strategy, export flows, and real market impact, especially in metals like nickel and lithium.

What makes her influence magnetic is her foresight and clarity, bridging Capitol Hill, global supply chains, and strategic investment like few can. Her message to industry is clear: Act now, don’t wait—by the time the funding arrives, it’ll be too late.

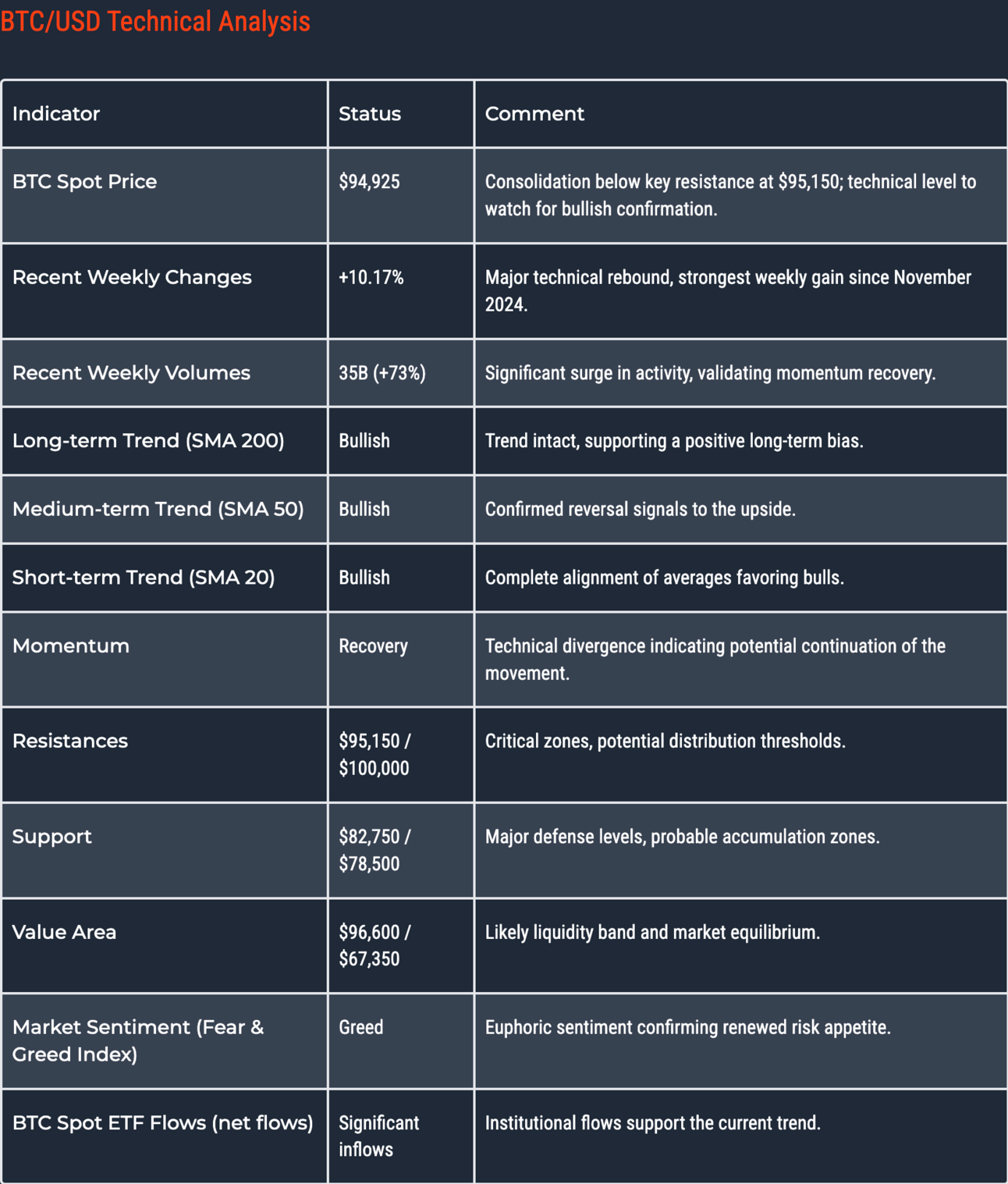

Bitcoin Is Heating Up — Is a Big Breakout Coming?

Bitcoin is gaining steam—here’s what’s fuelling the rally and the key levels to watch next.

Bitcoin just had its best week since November, jumping 10% and attracting a surge in investor interest. Right now, it’s sitting just below a key price level of $95,150, and many traders think it could be gearing up to test $100,000 soon.

Here’s what you need to know:

📊 Big increase in trading activity (+73%) shows momentum is building

✅ Bullish trend across short, medium, and long term

💥 If Bitcoin moves past $96,000, it could speed up and push toward $107,000

🛑 If it falls below $91,600, it might drop toward $84,000 or lower

💡 Analysts are saying the market looks strong for now — but upcoming U.S. economic data (like inflation and GDP) could shift things quickly.

This analysis is powered by expert insights from Elyfe.

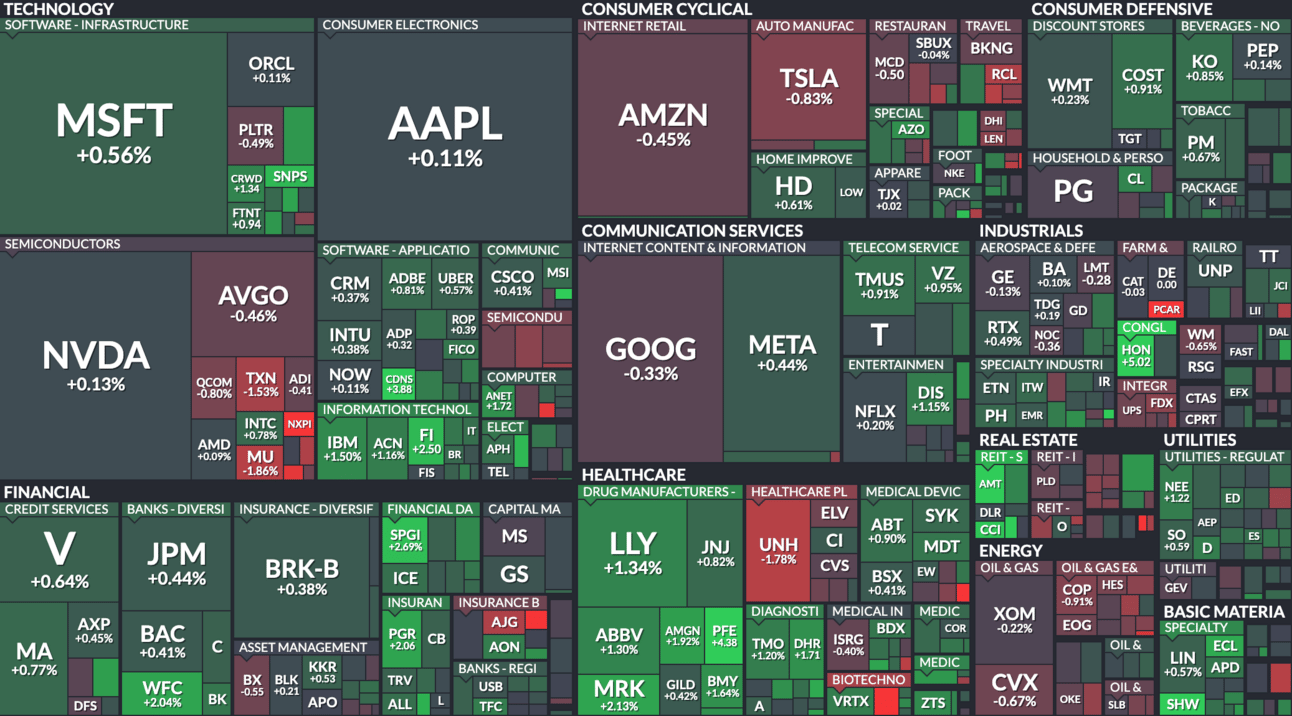

Market Snapshot Today:

📈 Top Gainers

Honeywell International (HON): Shares rose over 5% after the company reported better-than-expected earnings and revenue, raised the lower end of its profit forecast and outlined plans to address potential tariff effects.

Sherwin-Williams (SHW): The stock gained approximately 5% following a strong earnings report that surpassed profit estimates, driven by higher prices and lower costs.

Corning Inc. (GLW): Shares advanced due to strong demand for optical connectivity products used in AI infrastructure.

📉 Top Losers

Regeneron Pharmaceuticals (REGN): The stock dropped nearly 7% after missing revenue and earnings expectations, primarily due to underwhelming sales of its eye treatment Eylea.

NXP Semiconductors (NXPI): Shares fell over 7% following the announcement of CEO Kurt Sievers' resignation and uncertainty caused by tariffs.

Amazon.com Inc. (AMZN): The stock slipped after a White House spokesperson criticized its potential move to list tariff-related costs, leading to investor concerns.

All data current as of 1pm EST 04/29/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |