- Juniorstocks.com

- Posts

- Buffett Bows Out of Berkshire, Fed Looms, Palantir Plunges: Markets Brace for Impact, Gold Bulls call for $5,000/oz

Buffett Bows Out of Berkshire, Fed Looms, Palantir Plunges: Markets Brace for Impact, Gold Bulls call for $5,000/oz

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Warren Buffett officially steps down as CEO of Berkshire Hathaway, naming longtime successor Greg Abel to lead the $900B empire. Buffett will remain as chairman, but Abel now holds “the final word”—marking the end of a historic investing era.

Abel inherits not just a conglomerate, but a doctrine built on value investing, radical trust, and anti-bureaucracy. He’s expected to uphold Berkshire’s culture of humility, long-term thinking, and lean management while navigating a volatile, modern market landscape.

Markets responded calmly to the transition, with Berkshire stock holding steady, signalling investor confidence in the meticulously planned handoff. Now, all eyes are on Abel to protect Buffett’s legacy—and prove the system is bigger than the man.

Wall Street Hit by Tariff Shock & AI Cooldown

Stocks slide as Trump’s trade war rattles forecasts, Palantir tanks 13% and all eyes turn to the Fed’s next move.

📉 Market Turmoil: AI Hype Fizzles, Tariff Fears Surge

Wall Street’s momentum snapped again Tuesday as Trump’s tariffs fuel corporate uncertainty.

S&P 500: -1.1%, poised for 2nd straight drop after a rare 9-day winning streak

Dow Jones: -438 pts (-1.1%)

Nasdaq: -1.4%, hit hard by tech pullbacks

Markets now brace for today’s FOMC meeting, where Jerome Powell is expected to hold rates steady—igniting fresh tension with Trump, who demands cuts.

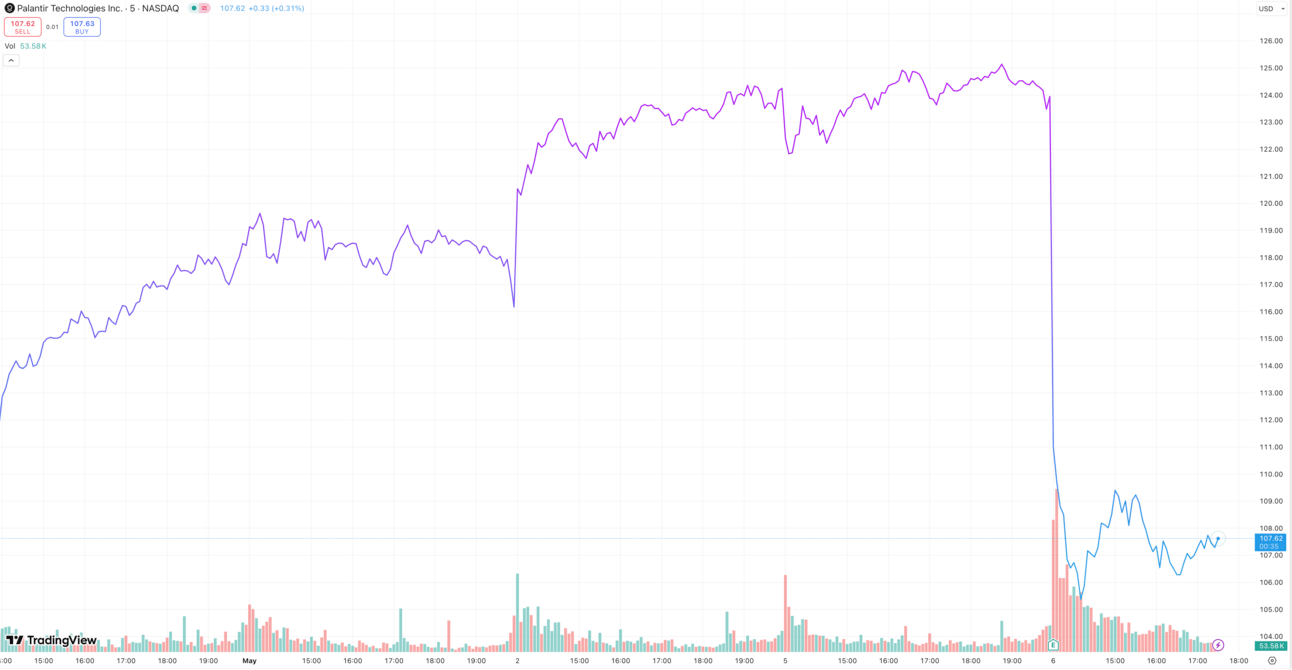

Palantir ($PLTR) stock price tanked Tuesday Morning

Palantir (PLTR): Down big despite meeting profit estimates

💰 Valuation Concerns:

Palantir's high valuation is a significant factor in the stock's drop. The company's forward price-to-earnings (P/E) ratio stands at approximately 202, which is substantially higher than peers like Snowflake (131), Salesforce (23.48), and Datadog (54.81). Such a lofty valuation leaves little room for error, and even strong performance may not suffice to justify the premium.

🌍 International Weakness:

While U.S. commercial revenue surged by 71%, Palantir's international commercial revenue declined by 5% year-over-year, primarily due to weakness in Europe. This disparity raises concerns about the company's global growth prospects.

📈 Technical Factors and Market Sentiment:

The stock's significant run-up—over 400% in the past year and 64% year-to-date—may have led to a "buy the rumor, sell the news" scenario. Additionally, technical indicators suggest a double top pattern, signalling potential further declines.

🔮 Analyst Perspectives:

Analyst opinions are mixed. Wedbush maintains an "outperform" rating with a price target of $140, citing strong AI demand. Conversely, Jefferies holds an "underperform" rating with a $60 target, pointing to valuation concerns.

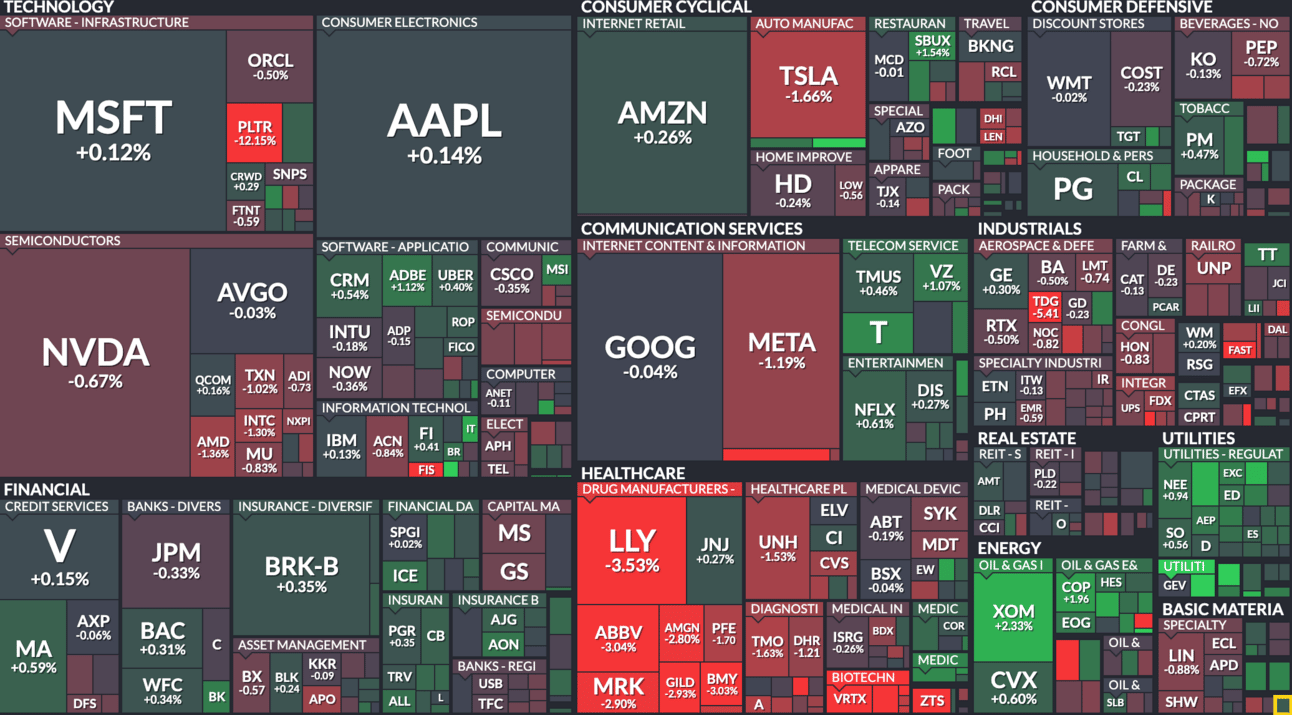

Market Snapshot Today:

AI and Software Stocks Retreat as Valuation Fears Hit

Palantir (PLTR -12.15%) dropped sharply despite solid earnings, as investors balked at its lofty valuation (P/E ~200) and weak international growth.

Meta (-1.19%), Tesla (-1.66%) and other high-momentum tech names pulled back as Wall Street reassessed AI euphoria in light of weaker-than-expected forward guidance from multiple firms.

Healthcare Sinks on Drugmaker Weakness

Eli Lilly (LLY -3.53%), Merck (MRK -2.90%) and AbbVie (ABBV -2.80%) fell after concerns emerged about pricing pressures and lackluster pipeline updates in upcoming FDA review sessions, as well as potential regulatory scrutiny around weight-loss drugs.

Energy and Utilities Outperform Amid Safe-Haven Shift

ExxonMobil (XOM +2.33%) and Chevron (CVX +1.96%) gained as oil prices rose on geopolitical tensions and U.S. refinery supply disruptions.

Defensive sectors like Utilities and Consumer Staples saw inflows, with NEE, SO, and PEP relatively stable as investors sought safety ahead of the FOMC rate announcement and ongoing tariff uncertainty.

All data current as of 12pm EST 05/06/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |