- Juniorstocks.com

- Posts

- Canada Fuels Critical Minerals, Buffett's Berkshire Reallocates Billions, US "Golden Era" for Energy Independence

Canada Fuels Critical Minerals, Buffett's Berkshire Reallocates Billions, US "Golden Era" for Energy Independence

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Strategic Investment in Quebec’s Mining Sector: Canada is investing up to $43.5 million, primarily through the Critical Minerals Infrastructure Fund (CMIF), to develop energy and transportation infrastructure that supports mining operations. Key beneficiaries include Critical Elements Lithium Corporation, Dumont Nickel, Sayona Nord Inc., Eskan Company, Cbay Minerals Inc. and Commerce Resources.

Driving Innovation & Sustainability: The Critical Minerals Research, Development and Demonstration (CMRDD) program is allocating $3.7 million to refine lithium extraction processes, reducing waste and supporting sustainable mining. These initiatives align with Canada's climate goals by ensuring a stable supply of critical minerals essential for renewable energy and electric vehicle production.

Strengthening Canada’s Global Position: This investment enhances Canada's role in the global critical minerals market by reducing reliance on foreign suppliers, particularly China. The initiative fosters economic resilience, job creation, and Indigenous business opportunities while securing Canada’s place as a leader in sustainable resource development.

Buffett’s Bold Moves: Where Berkshire’s Billions Are Flowing

Berkshire Hathaway's shift from Apple to Sirius XM, Domino's, and Pool Corp signals strategic diversification into media, consumer, and leisure sectors, focusing on strong market players with lasting competitive edges.

Apple Inc. (AAPL): Berkshire significantly reduced its stake in Apple, selling 100 million shares in the third quarter of 2024. This followed a prior reduction of nearly 50% in the second quarter, bringing the total reduction to about two-thirds from the 905 million shares held at the start of the year.

Sirius XM Holdings Inc. (SIRI): In late January and early February 2025, Berkshire acquired over 2.3 million additional shares of Sirius XM, bringing its total holdings to more than 119.78 million shares, surpassing a 35% stake in the company.

Domino's Pizza Inc. (DPZ): During the third quarter of 2024, Berkshire purchased approximately 1.28 million shares of Domino's Pizza, valued at $549 million as of September 30, 2024.

Pool Corporation (POOL): In the same quarter, Berkshire acquired about 404,000 shares in Pool Corp, worth $152 million.

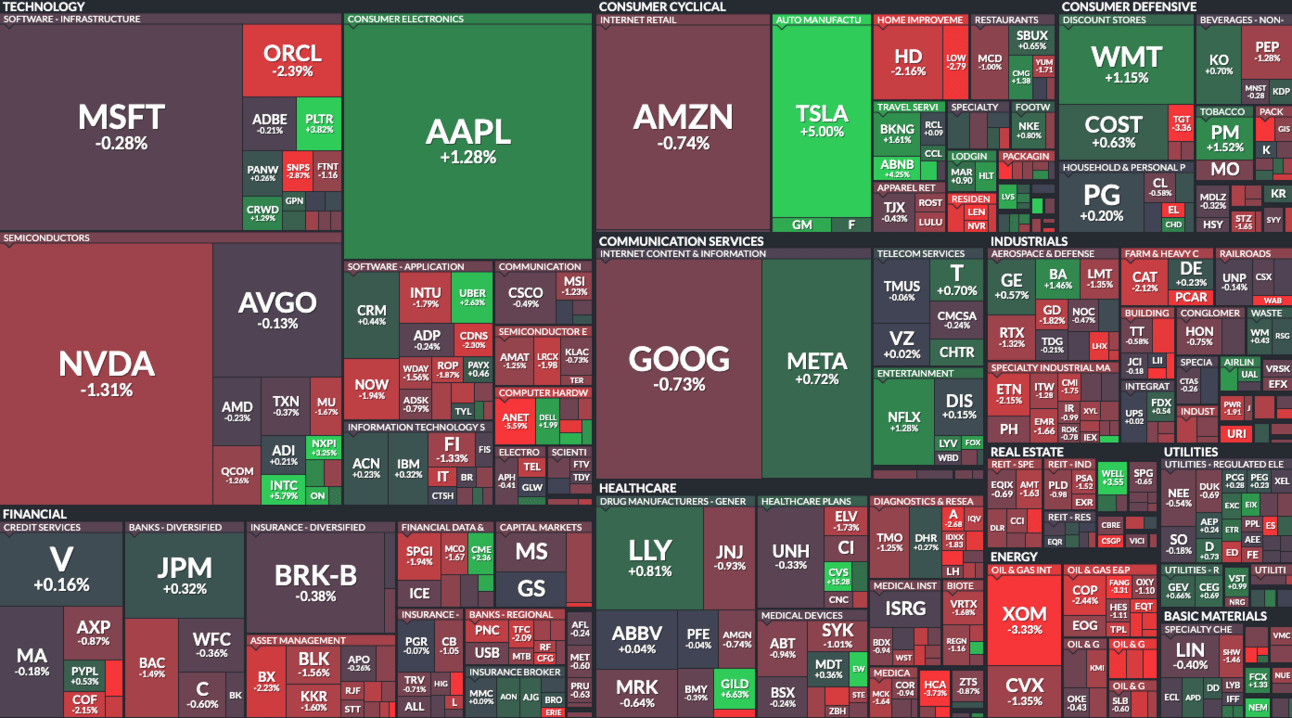

Market Snapshot Today:

Technology & Semiconductors Mixed Performance: Apple (AAPL) gained +1.28%, while Microsoft (MSFT) (-0.28%) and Google (GOOG) (-0.73%) saw slight declines. Nvidia (NVDA) dropped -1.31%, along with AMD (-0.37%) and QCOM (-1.26%), reflecting weakness in semiconductors. Meanwhile, Tesla (TSLA) surged +5.00%, standing out in the auto sector.

Financial & Energy Sectors Decline: While JPMorgan (JPM) (+0.32%) and Visa (V) (+0.16%) posted small gains, Bank of America (BAC) (-1.49%) and asset managers like BlackRock (BLK) (-1.60%) struggled. Energy stocks performed poorly, with ExxonMobil (XOM) down -3.33% and Chevron (CVX) down -1.35%.

Retail & Consumer Sectors Show Mixed Trends: Walmart (WMT) (+1.15%) and Costco (COST) (+0.63%) gained, while Amazon (AMZN) fell (-0.74%), reflecting shifts in consumer spending. Home Depot (HD) (-2.16%) and McDonald's (MCD) (-1.79%) struggled, suggesting weaker demand in home improvement and fast food.

All data current as of 1pm EST 02/12/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |