- Juniorstocks.com

- Posts

- Trump vs. Trudeau, Super Micro faces Nasdaq Delisting, McTrouble for Canadian Potash Tariffs

Trump vs. Trudeau, Super Micro faces Nasdaq Delisting, McTrouble for Canadian Potash Tariffs

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

U.S. Tariffs on Canadian Critical Minerals: Following Trump’s election, the U.S. imposed 25% tariffs on most Canadian goods and 10% on critical minerals, straining Canada-U.S. trade relations and impacting Canada's mining sector.

Economic Importance of Critical Minerals: Canada’s 34 critical minerals, essential for industries like renewable energy and defense, are valued at $325 billion, with demand expected to triple by 2040, contributing over $500 billion to Canada’s GDP.

Geopolitical and Economic Implications: The U.S. aims to secure supply chains amid global tensions, but tariffs may push Canada to seek new markets, risking higher costs for U.S. industries and disrupting North American supply networks.

Super Micro Shares Surge ahead of Nasdaq Delisting Deadline

SMCI Faces Nasdaq Delisting Threat Amid Auditor Resignation and Accounting Controversy

Super Micro Computer (SMCI) shares surged over 12% as it prepares to file delayed financial reports by Feb. 25, despite facing SEC and DOJ subpoenas, with no restatement of financials required.

The company reported preliminary Q2 net sales between $5.6B-$5.7B and revised its fiscal 2025 sales forecast down to $23.5B-$25B, while maintaining steady net income margins.

Super Micro (SMCI) highlighted its AI infrastructure growth, citing partnerships with Nvidia (NVDA) and advanced cooling systems, alongside a $700M private sale of convertible notes due 2028.

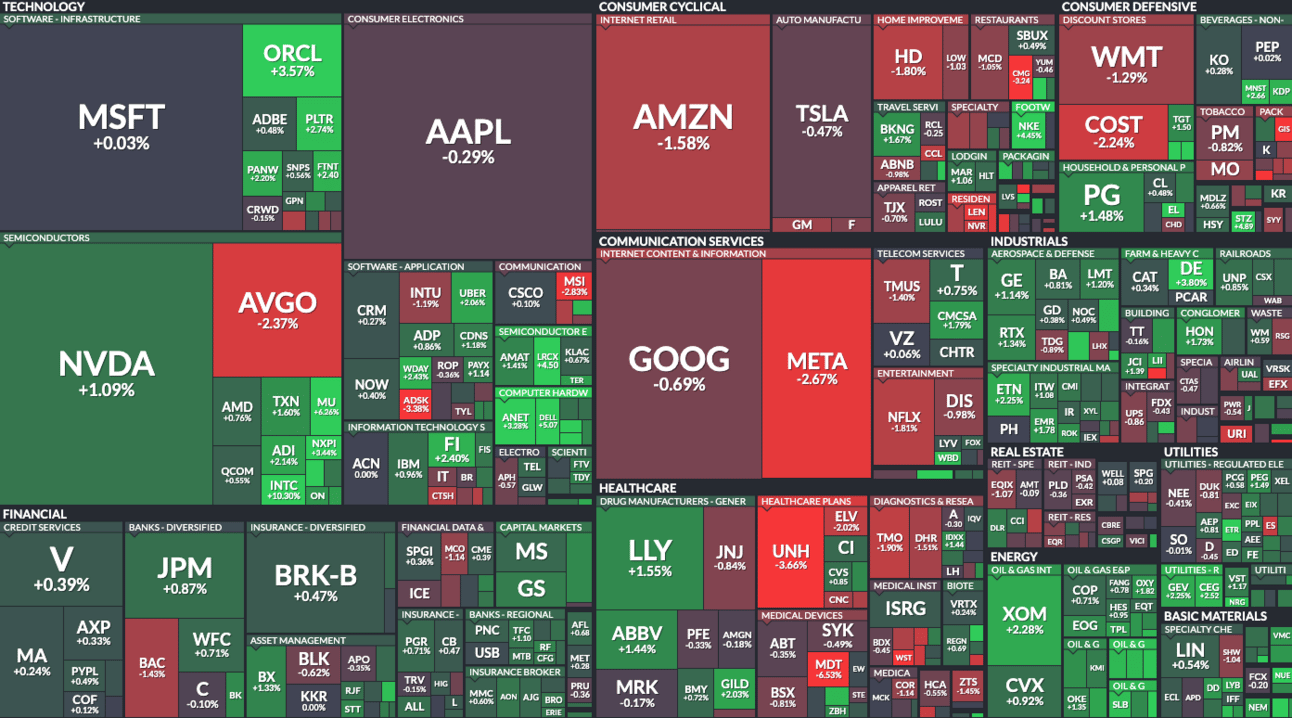

Market Snapshot Today:

Technology sector showed mixed performance: NVIDIA (NVDA) rose +1.09%, Oracle (ORCL) gained +3.57%, and Broadcom (AVGO) dropped -2.37%. Microsoft (MSFT) remained flat (+0.03%), while Apple (AAPL) declined -0.29%.

Consumer sectors faced significant losses: Amazon (AMZN) dropped -1.58%, Walmart (WMT) -1.29%, and Costco (COST) -2.24%. Starbucks (SBUX) was a rare gainer in this sector with +0.49%.

Healthcare sector struggled overall: UnitedHealth (UNH) fell -3.66%, Medtronic (MDT) -6.53%, and Johnson & Johnson (JNJ) -0.84%. However, Eli Lilly (LLY) gained +1.55% and AbbVie (ABBV) +1.44%.

All data current as of 1pm EST 02/18/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |