- Juniorstocks.com

- Posts

- Sweden's push for Nuclear, EOY Market Rally and the Coming Mineral Wars

Sweden's push for Nuclear, EOY Market Rally and the Coming Mineral Wars

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Sweden plans to lift its uranium mining ban by 2026 to boost energy independence, support low-carbon nuclear power, and drive economic growth.

Policy Shift for Energy Security – Sweden is considering lifting its uranium mining ban, effective January 1, 2026, to support low-carbon energy goals and enhance energy independence.

Economic and Environmental Impact – With 25% of Europe’s uranium reserves, Sweden aims to create jobs, reduce reliance on foreign resources, and ensure ethical, sustainable extraction under strict environmental regulations.

Strategic Resource Utilization – Supported by stakeholders like Aura Energy, Sweden’s uranium reserves could fuel nuclear power for 300+ years, boosting economic growth and climate action through safe, zero-emission energy.

Market Snapshot:

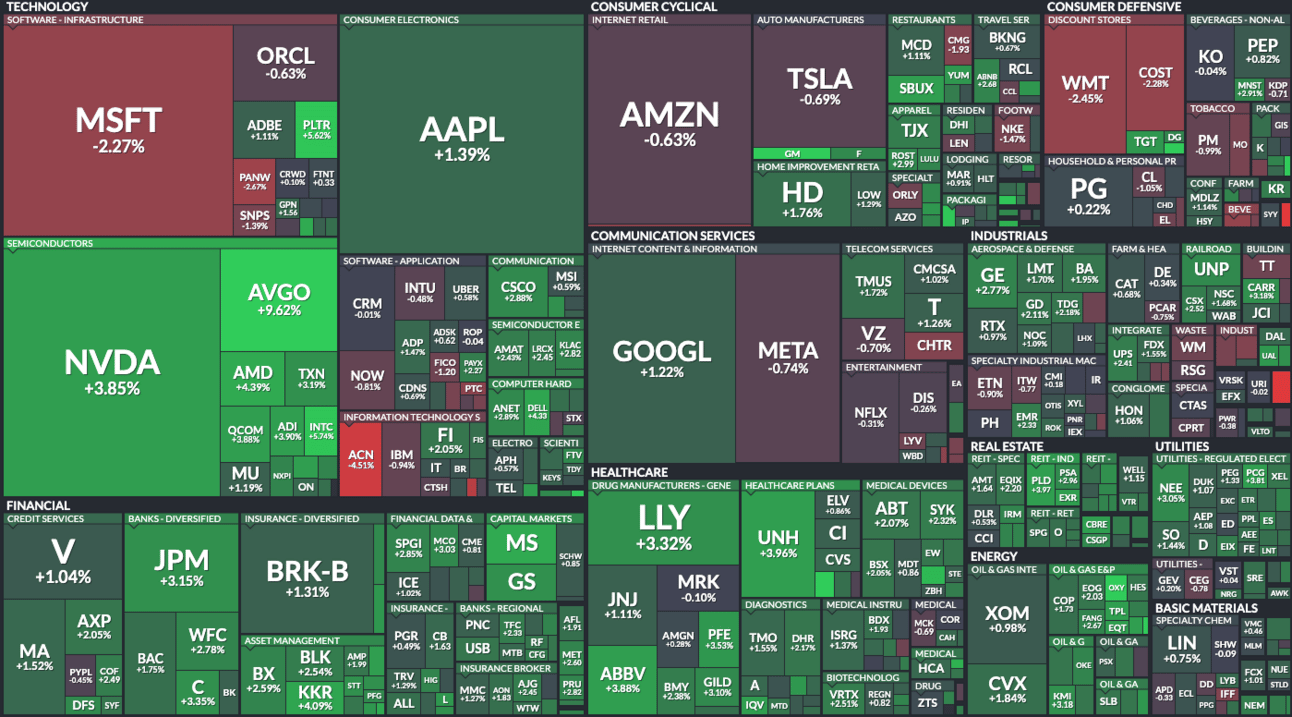

Growth and Cyclical Strength – Technology, particularly semiconductors (NVDA +3.85%, AVGO +9.62%) and healthcare (LLY +3.32%, ABBV +3.88%) led gains, driven by AI adoption, pharmaceutical demand, and economic resilience. Financials (JPM +3.15%, C +3.35%) benefited from higher interest rates and improving credit conditions.

Defensive Weakness and Sector Rotation – Consumer staples (WMT -2.45%, COST -2.28%), lagged as investors rotated into growth-focused stocks, reflecting optimism about economic expansion, infrastructure investments, and AI-driven innovation despite inflation concerns and consumer spending pressures.

Technical Analysis - SoundHound AI (SOUN)

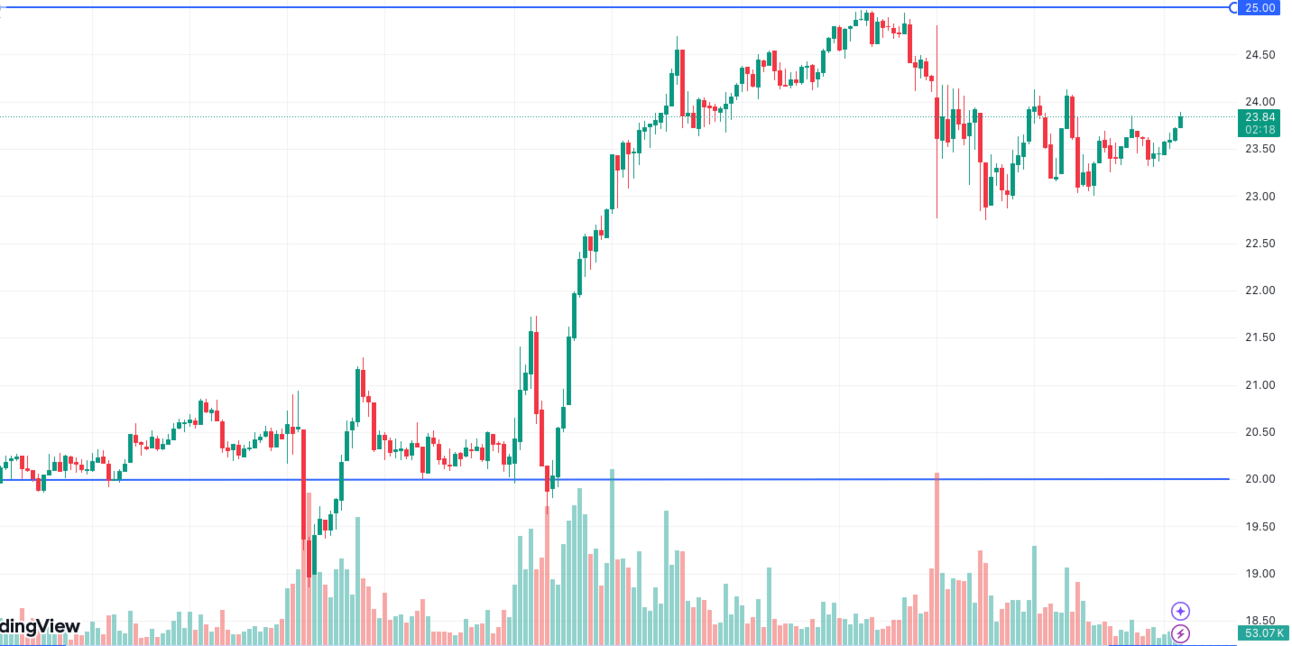

Bullish Bias: Momentum is strong, supported by volume (Avg ~57 million), but the $25.00 resistance could trigger further consolidation.

Key Watch Areas:

Support realized around $20.00 , where the stock found stability after its earlier dip.

Hold above $23.00 to maintain bullish momentum.

Break above $25.00 could signal further upside, while dropping below $22.00 may indicate weakening momentum.

Trading Strategy: Look for confirmation above $25.00 for a breakout or wait for pullbacks near support for better entry points.

Data current as of 12/27/2024 1pm EST

Top Viewed Articles this week:

Junior Mining Updates:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |