- Juniorstocks.com

- Posts

- UK PM Slashes Nuclear Red Tape, Power Movers Amid Antimony Supply Crisis, Trump Eyes Ukraine's Rare Earths

UK PM Slashes Nuclear Red Tape, Power Movers Amid Antimony Supply Crisis, Trump Eyes Ukraine's Rare Earths

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Revitalizing Nuclear Energy: The UK government, under Prime Minister Keir Starmer, is implementing major reforms to accelerate nuclear power development, including cutting red tape, expanding planning approvals, and supporting Small Modular Reactors (SMRs) to boost economic growth and energy security.

Breaking Regulatory Barriers: The reforms eliminate outdated restrictions, allowing nuclear projects to be proposed beyond the previously limited eight sites, providing long-term stability for investors and expediting project approvals through a newly formed Nuclear Regulatory Taskforce.

Energy Security & Economic Impact: Nuclear energy is positioned as a key solution to reducing reliance on volatile global energy markets, ensuring stable power for industries like AI and technology, while unlocking billions in investment, creating jobs, and securing long-term energy affordability.

Three Companies Taking Advantage of the Global Antimony Shortage

High-Impact Antimony Investment Opportunities You Need to Know

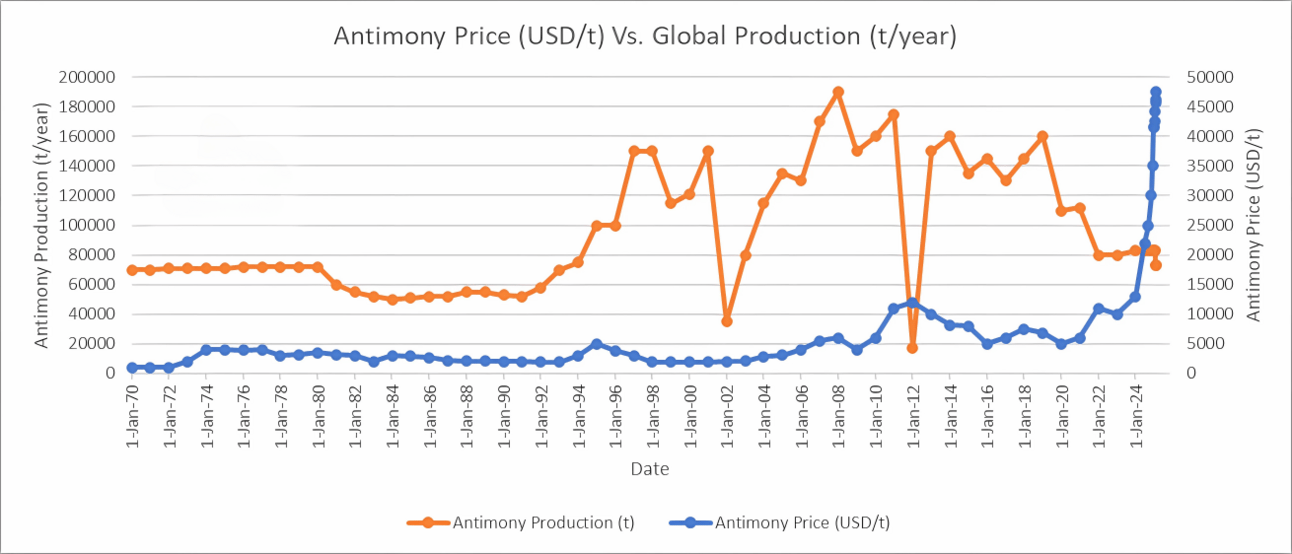

Antimony Supply Squeeze Begins in 2020: Sparks Soaring Prices

Military Metals (CSE: MILI | OTCQB: MILIF): Military Metals offers high leverage to rising antimony prices, a diverse geographic asset base, and direct exposure to European and North American defense supply chains. As Western nations scramble to secure new supply, Military Metals’ high-grade, strategically located assets could attract government funding and defense partnerships.

Perpetua Resources (NASDAQ: PPTA | TSX: PPTA): Perpetua is a lower-risk investment due to strong U.S. government support, but its primary focus is gold rather than antimony. While investors gain exposure to both gold and antimony, Perpetua is not a pure-play antimony company. However, with direct U.S. defense funding, the project is well-positioned for long-term success.

United States Antimony Corporation (NYSE: UAMY): UAMY offers exposure to the downstream side of the antimony supply chain, but its lack of mining assets means it is dependent on securing reliable feedstock. The company could benefit from government initiatives to process domestic antimony, but it lacks the resource upside potential of Military Metals and Perpetua.

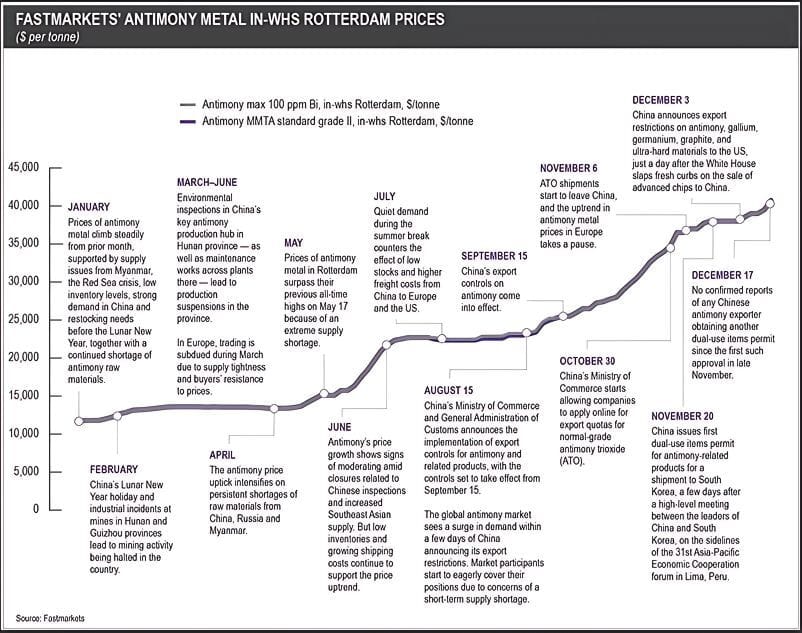

Fastmarkets: 2024 Analysis of Rising Antimony Prices

Market Snapshot This Week:

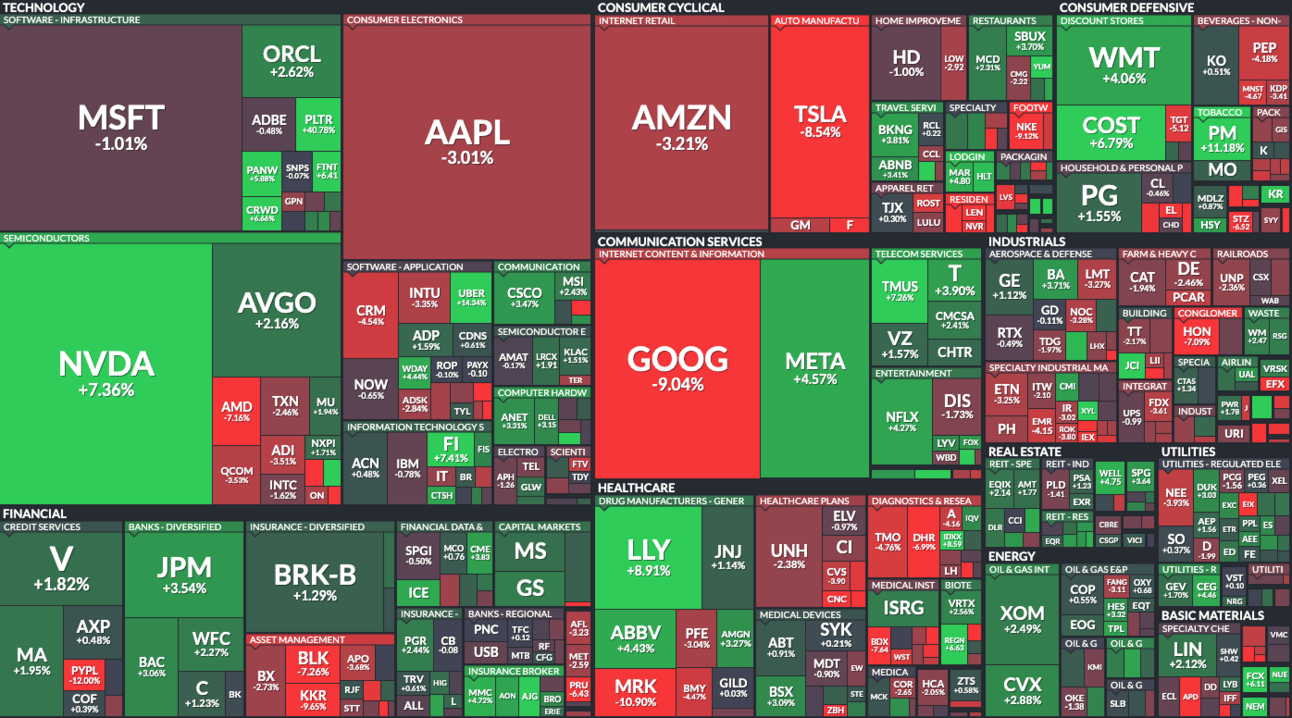

Tech Sector Mixed: Microsoft (MSFT) -1.01% and Apple (AAPL) -3.01% declined, NVIDIA (NVDA) jumped +7.36% driven by investor optimism ahead of its upcoming earnings report. Alphabet (GOOG) suffered a steep -9.04% drop as investors are wary following the earnings report released on February 4th.

Tesla Drops Hard, Financials & Healthcare See Mixed Results: Tesla (TSLA) plunged -8.54% while JPMorgan (JPM) up +3.54%, but PayPal (PYPL) and BlackRock (BLK) struggled. Healthcare had notable divergence, with Eli Lilly (LLY) gaining +8.91%, but Merck (MRK) falling -10.9%.

Consumer Defensive and Energy Sectors Hold Strong: Walmart (WMT) +4.06% and Costco (COST) +6.79% led consumer defensive gains, while ExxonMobil (XOM) and Chevron (CVX) saw modest increases around +2.5-2.9% in energy.

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |