- Juniorstocks.com

- Posts

- Stan Wong's Kangaroo Market, Trump's Roller Coaster Week: What Happened, Market Uncertainty: Transition to GOLD?

Stan Wong's Kangaroo Market, Trump's Roller Coaster Week: What Happened, Market Uncertainty: Transition to GOLD?

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Volatility = Opportunity: Despite rising fear indicators like the VIX and extreme sentiment readings, Stan Wong sees current market turbulence as a contrarian buy signal, not a reason to panic. Drawing on past crises (2008, 2018, 2020), he advocates for staying disciplined and long-term focused.

Strategic Picks Amid Chaos: Wong is doubling down on fundamentally strong, technically supported names like Apple (near long-term support, strong services growth), Expedia (riding post-pandemic travel boom), and the Invesco S&P 500 Equal Weight ETF (diversified exposure, avoids mega-cap risk).

Build, Don’t Bail: Rather than fleeing to cash, Wong is reallocating with precision—favoring resilience over reaction. His philosophy: prepare, don’t predict. In volatile times, smart portfolio construction and mindset discipline matter most.

Your move—are you playing defense or going on the offensive in today’s volatile market? Share your strategy on LinkedIn and join the conversation with investors exploring Stan Wong’s contrarian picks and long-term approach to navigating uncertainty.

Trump’s Roller Coaster: What Happened this Past Week

Coal power, China clashes, executive orders collide—here’s how Trump’s tariff blitz is shaking global markets and D.C. alike.

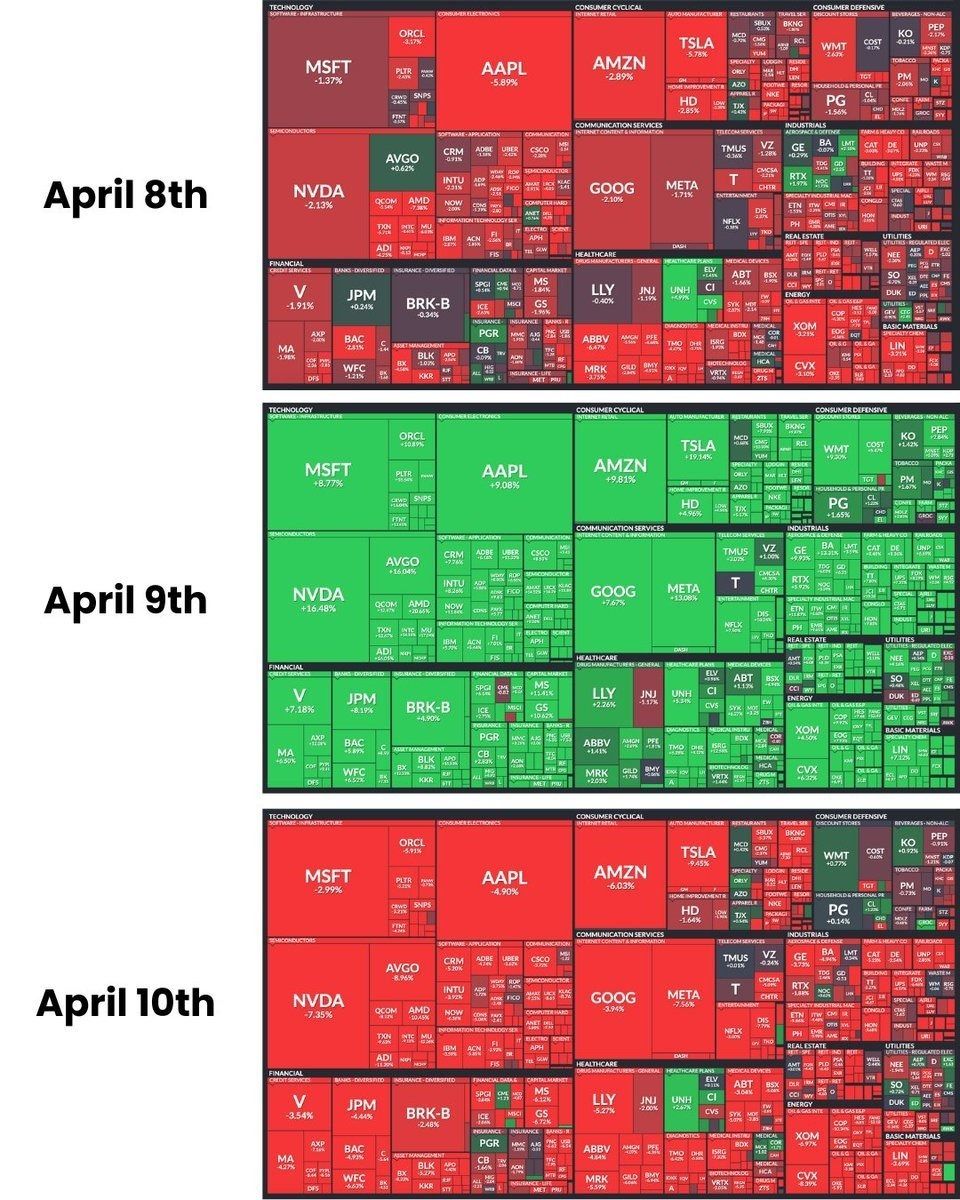

Tuesday, April 8th, 2025

The S&P 500 dropped 3.9% to 490, with a late sell-off erasing a 4% intraday gain, triggered by confirmation of a 50% tariff on Chinese goods.

The Dow Jones fell 320 points (0.84%) to 37,645, while the Nasdaq declined 2.15%, reflecting broad market weakness.

Major stocks like Amazon (-2.89%) and Nvidia (-2.13%) saw declines, amid fears of escalating trade tensions.

Wednesday, April 9th, 2025

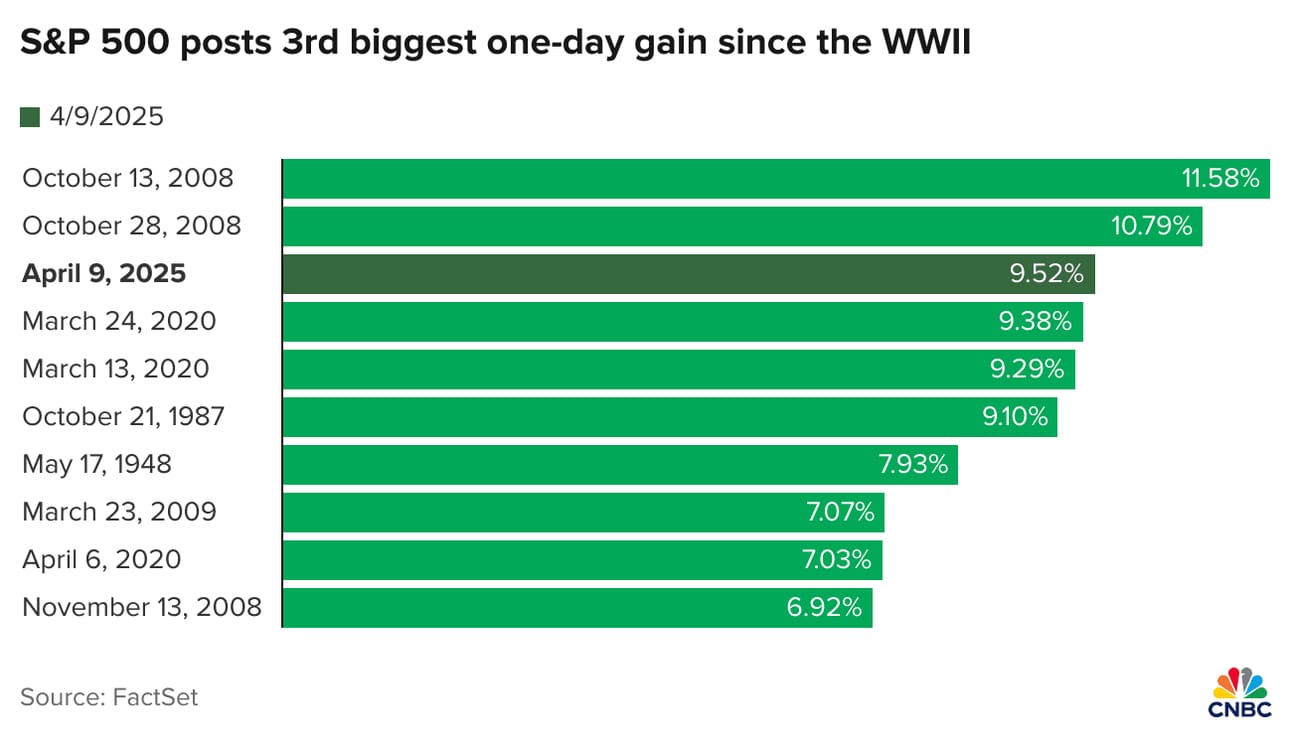

The S&P 500 surged 11.3% to 545 settling on a one-day gain of 9.52%, marking one of the largest daily gains since WW2, after a 90-day tariff pause was announced for most countries except China.

Tech stocks led the rally, with Nvidia (+16.48%) and Microsoft (+8.77%) showed strong gains.

Global markets also rose, with Japan’s Nikkei up 9.1% and European markets gaining 3-4%, reflecting optimism for trade negotiations.

Thursday, April 10th, 2025

The S&P 500 fell 4.4% to 522, and the Dow dropped 2,231 points (5.5%) to 38,314 as China imposed a 34% levy on U.S. products.

The Nasdaq entered bear market territory, down 5.8% to 15,587, with tech stocks like Nvidia (-7.35%) and Apple (-2.99%) hit hard.

Fears of a global trade war intensified, with Goldman Sachs raising its recession risk forecast to 45% amid tariff-related uncertainty.

April 8, 9, 10th Market Swings

Market Snapshot Today:

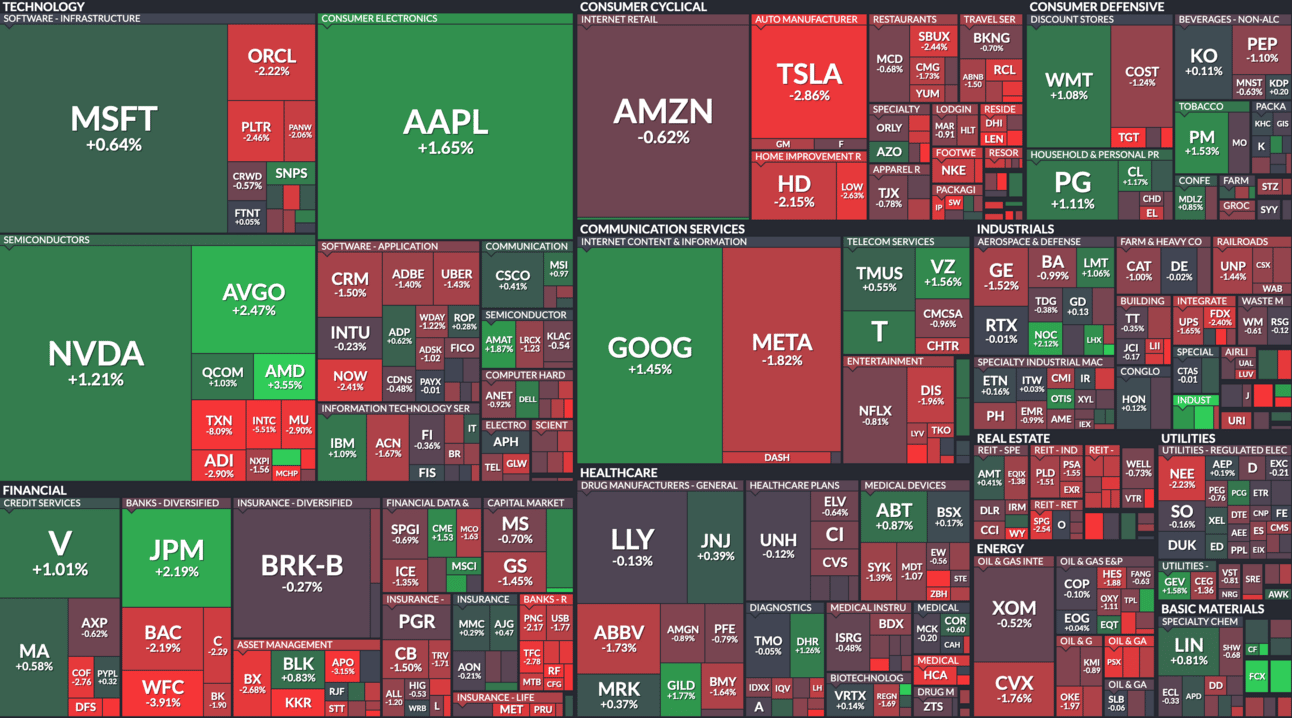

Semis Mixed Amid Tariff Tensions

AMD +3.55%, AVGO +2.47%, NVDA +1.21% rose as AI demand continues to drive bullish momentum—despite harsh U.S.-China tech tariffs kicking in.

TXN -8.09% and INTC -5.51% sank on warnings of weakened global chip demand and supply chain retaliation risk from China.

Big Tech Diverges on Macro Pressure

AAPL +1.65%, GOOG +1.45%, MSFT +0.64% climbed as investors rotated into perceived AI-safe megacaps.

META -1.82%, TSLA -2.86% fell as social media and EV demand cooled amid EU trade threats and global consumer slowdown fears.

Financials & Industrials Under Fire

WFC -3.91%, BAC -2.19%, GE -1.52%, CAT -1.00% dropped on fears that tariffs and trade wars will dent credit, construction, and global industrial activity.

Investors show concern over slowing loan growth and higher operating costs from retaliatory tariffs.

All data current as of 12pm EST 04/11/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |