- Juniorstocks.com

- Posts

- Gold Strike Begins: Sanatana Takeover, Futures Soar as Trump Teases 50% Copper Tariffs, Antimony Revival Begins at West Gore

Gold Strike Begins: Sanatana Takeover, Futures Soar as Trump Teases 50% Copper Tariffs, Antimony Revival Begins at West Gore

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Major Yukon & Quebec Acquisitions: Sanatana Resources is transforming itself through a reverse takeover to acquire the Gold Strike One Project in Yukon—adjacent to Snowline Gold’s 8.8 Moz Valley Deposit—and the Abitibi Property in Quebec’s Abitibi Greenstone Belt, positioning itself near significant gold and base metal discoveries.

Promising Early Exploration Data: Prior soil, rock, and geophysical surveys indicate widespread gold anomalies on the Yukon property, consistent with the reduced intrusion-related gold system (RIRGS) model, suggesting potential continuity with Snowline’s expanding deposit just 500 meters away.

Strategic Corporate Shift: The deal, largely paid in equity, signals vendor confidence and will see Sanatana rebranded as Gold Strike Resources Corp., aiming for a fresh start with an expanded land position, regulatory hurdles pending, and aggressive exploration planned for summer 2025.

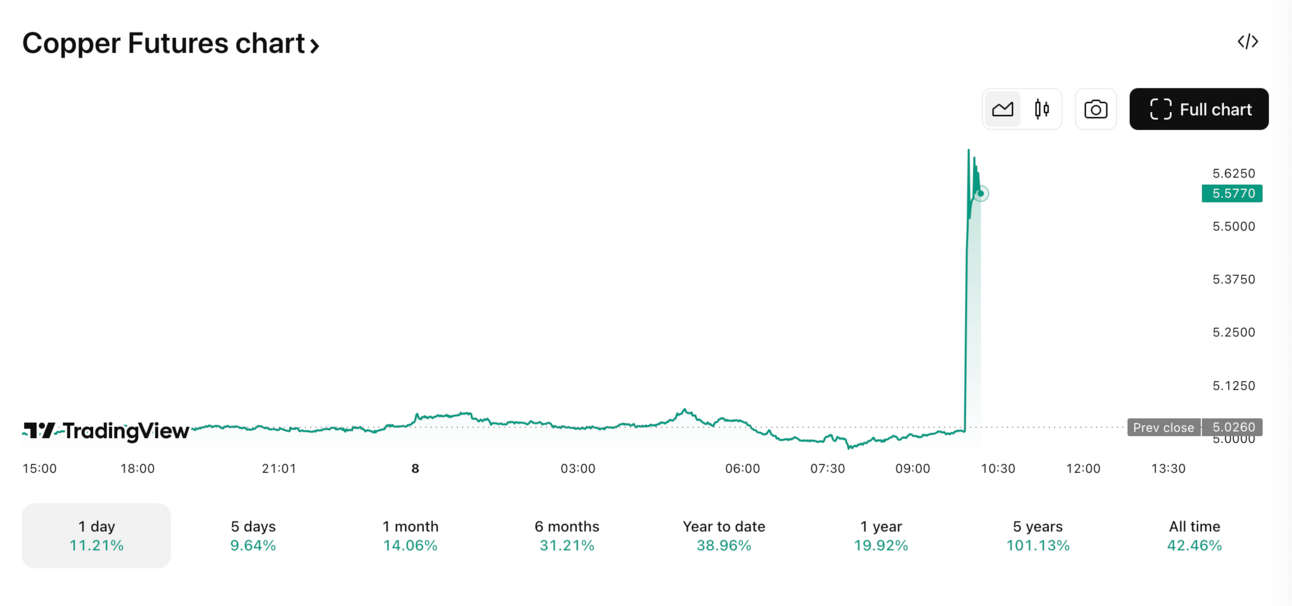

Trump’s 50% Tariff on Copper: Futures Soar

Copper futures surged over 11% today, spiking above $5.57/lb, after President Trump announced plans to impose 50% tariffs on copper imports igniting fears of supply disruptions and cost inflation in the U.S. manufacturing sector.

Such tariffs would likely reduce foreign copper flows into the U.S., tighten domestic supply and push prices even higher, impacting industries from electronics to construction and renewable energy projects that rely heavily on copper.

Producers and traders could see significant volatility, while end users may face higher costs and potential delays, as markets brace for possible trade wars and re-routing of global copper trade flows.

Is this just more Trump rhetoric, or will copper prices keep soaring?

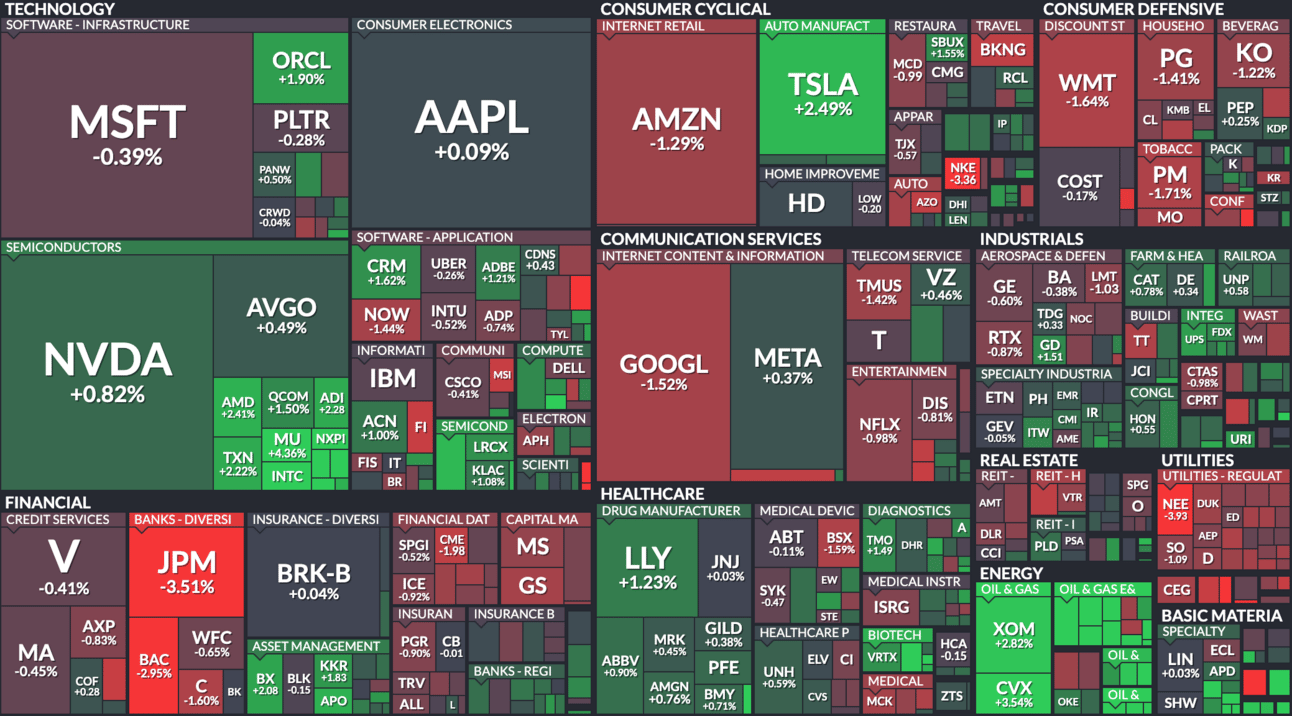

Market Snapshot Today:

Nvidia (NVDA +0.82%) and peers like Micron (MU +4.36%) and AMD (+2.41%) rose as enthusiasm remains strong for AI-driven semiconductor demand, following new reports of increasing data center investment and sustained enterprise AI adoption. However, software giants like Microsoft (-0.39%) and Google (-1.52%) saw mild declines amid profit-taking after recent highs and cautious outlooks for cloud spending growth.

Financials were mostly red, with JPMorgan Chase (-3.51%) and Bank of America (-2.95%) falling sharply as recent economic data fueled speculation that the Fed might cut rates sooner than expected. Lower rates could squeeze net interest margins, pressuring bank profitability. Meanwhile, asset managers like Blackstone (+2.08%) gained on expectations of a more favorable environment for deal-making and capital markets activity.

ExxonMobil (+2.82%) and Chevron (+3.54%) rallied as oil prices climbed following fresh Middle East tensions and a drop in U.S. crude inventories. Tesla (+2.49%) rebounded strongly amid reports of higher-than-expected deliveries in China for June, easing concerns over EV demand softness in key markets.

All data current as of 1pm EST 07/08/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |