- Juniorstocks.com

- Posts

- Robert Kiyosaki Sounds the Alarm, Choked by China: Rare Earth Chess, NVIDIA Announces USA Production

Robert Kiyosaki Sounds the Alarm, Choked by China: Rare Earth Chess, NVIDIA Announces USA Production

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Kiyosaki declares the crash is here: He argues the global financial system has already collapsed in essence—pointing to surging gold, silver, and Bitcoin prices as signals of a shift away from fiat currencies and traditional markets. He blames central banks for orchestrating a debt-driven illusion of prosperity.

Calls for radical asset shift: Kiyosaki urges people to exit stocks, bonds, and ETFs, and instead move into physical gold, silver, and Bitcoin to preserve wealth. He sees these as survival tools in a broken financial system, emphasizing self-reliance and decentralized assets.

His warning is gaining traction: With gold demand surging, silver shortages appearing, and crypto platforms booming, Kiyosaki’s followers are growing. Even major institutions like BlackRock are echoing concerns about systemic cracks, lending weight to his long-standing predictions.

The Crash Is Now — Do You Agree?

Robert Kiyosaki says the financial system is collapsing and it's time to pivot to gold, silver, and Bitcoin. Do you think he's right—or just fear-mongering? Share your perspective on LinkedIn and join the conversation with investors questioning the future of money.

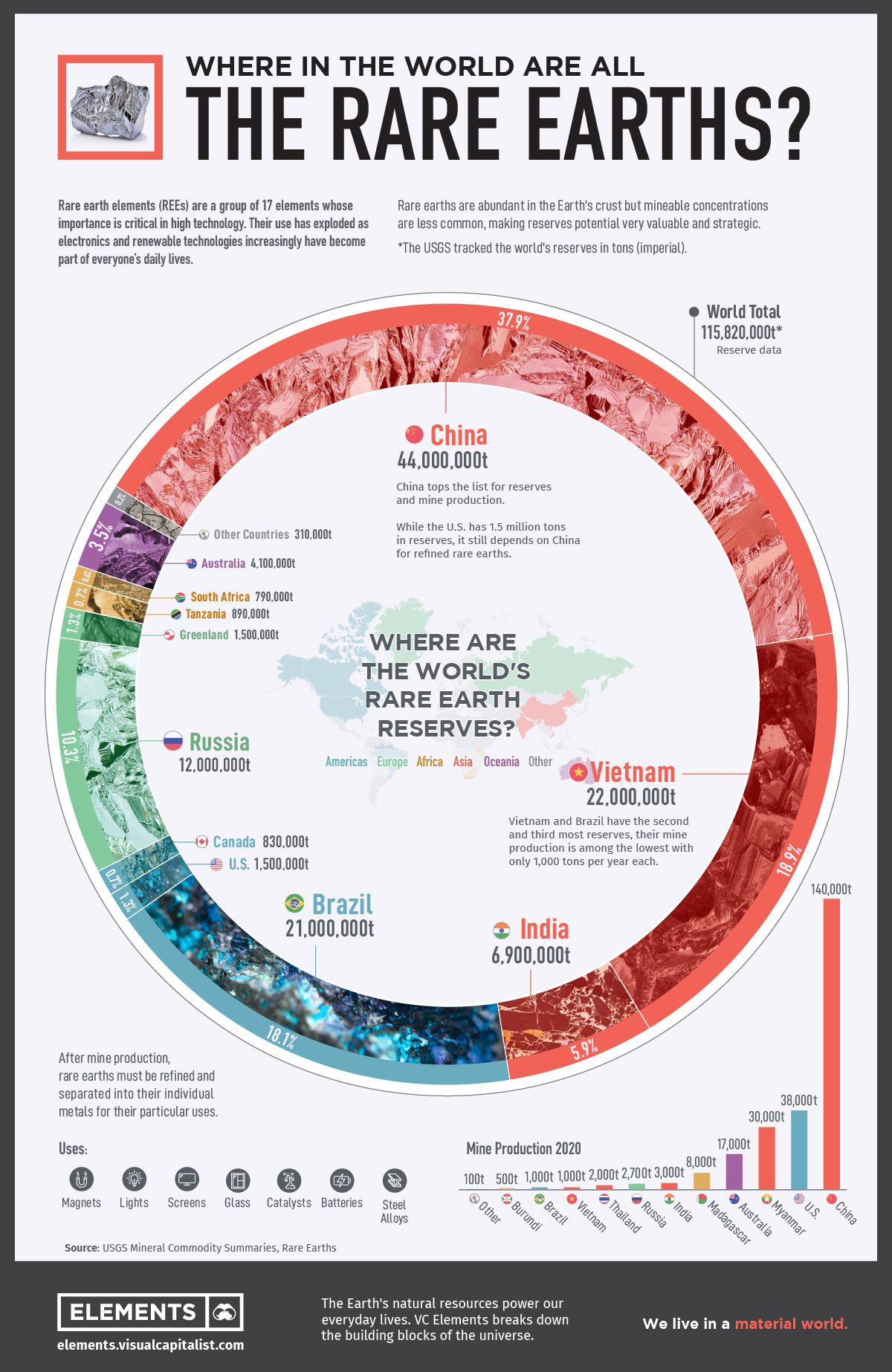

Choked by China: How Rare Earths Became America’s Achilles’ Heel

As Beijing tightens control over seven critical rare earths, a new CSIS report warns the U.S. has no way to replace the supply—putting its military edge and tech supply chain at risk.

Source: VisualCapitalist

China Targets U.S. Defense Supply Chain: Beijing imposed export controls on another 7 rare earths this week—samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium—all critical for U.S. defense tech like fighter jets, submarines, missiles, and radar.

U.S. Vulnerability Is Acute: The U.S. currently has no heavy rare earth separation capacity, and can't replace China's supply. CSIS warns this will directly threaten military readiness and widen the tech gap with China.

Production Bottlenecks Until at Least 2027: Despite $439M invested since 2020, the U.S. won’t have meaningful domestic rare earth output for years.

Blacklisting of U.S. Firms Escalates Tensions: China added 16 U.S. defense and aerospace companies to its export control list, cutting off access to dual-use materials like rare earths—deepening the economic and military rift.

Global Scramble for Alternatives Begins: Nations like Canada, US and the EU are ramping up rare earth investments, but China’s dominance—and control over other minerals like antimony, cobalt and palladium—gives it major geopolitical leverage.

Small-Cap Warriors Racing to Close America’s Critical Minerals Gap

Military Metals Corp. (CSE: MILI, OTCQB: MILIF)

Focus: Military Metals Corp. specializes in securing and advancing Western-aligned sources (outside of China and Russia) of strategic metals, with a strong emphasis on antimony—a critical material for ammunition, flame retardants, and military alloys.

Significance: Antimony is a top-priority mineral on the U.S. Department of Defense’s critical minerals list, highlighting its vital role in munitions and national security. Military Metals is positioning itself as the leading “antimony pure play,” dedicated to reducing U.S. dependence on Chinese and Russian supplies, strengthening domestic security, and capitalizing on a high-demand market.

Status: As an ambitious exploration and acquisition-driven company, Military Metals is actively developing high-potential brownfield assets in Slovakia, Canada, and the U.S. It stands alone as the only pure-play antimony company fully committed to domesticating and optimizing the supply chain for this essential resource.

USA Rare Earth Inc. (Nasdaq: USAR)

Project: Round Top Mountain in Texas — a large deposit containing both light and heavy rare earth elements.

Focus: Aims to develop a fully integrated U.S. rare earth supply chain—from mining to rare earth magnet manufacturing.

Significance: Could supply over 130 years of U.S. demand for many rare earths. Also building a rare earth magnet facility in Oklahoma, reducing reliance on Chinese imports.

Rare Element Resources Ltd. (OTCQB: REEMF)

Project: Bear Lodge Project in Wyoming — one of the highest-grade rare earth projects in North America.

Focus: Targeting critical magnet materials like neodymium and praseodymium.

Recent Developments: Received U.S. Department of Energy funding to construct a demonstration-scale processing plant.

Significance: Positioned to become a key U.S. supplier of rare earth elements used in defense and clean energy sectors.

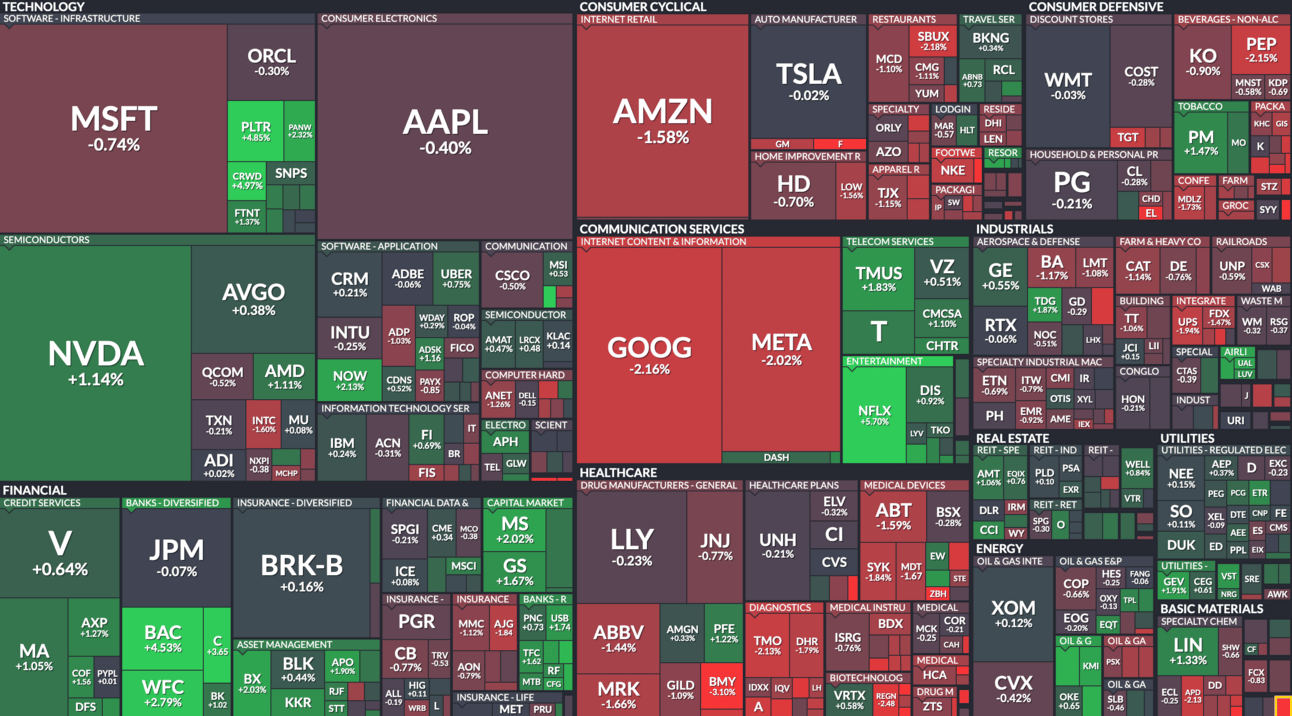

Market Snapshot Today:

Tech Split: AI and Cybersecurity Surge, Big Tech Slips: Nvidia (+1.14%), AMD (+1.11%), and cybersecurity stocks like CrowdStrike (+4.97%) and Palantir (+4.85%) jumped on fresh AI demand and government cybersecurity contracts. Google (-2.16%), Meta (-2.02%), and Microsoft (-0.74%) slid as investors rotated out of mega-cap tech following warnings about overvaluation.

Streaming & Telecom Pop, Retail and Pharma Slump: Netflix (+5.70%) rallied after beating subscriber growth estimates, while T-Mobile (+1.83%) rose on merger speculation with a regional carrier. Consumer names like Amazon (-1.58%) and Target (-1.37%) dropped on weak retail sales data, and pharma giants like Merck (-1.66%) and Bristol Myers (-3.10%) fell on disappointing drug trial updates and pricing pressure concerns.

Banks Climb on Earnings Beats, Shipping & Defense Fall: Financials like Wells Fargo (+2.79%), Bank of America (+2.03%), and Morgan Stanley (+2.02%) rallied on strong Q1 results and higher interest margin guidance. Meanwhile, defense stocks like Boeing (-1.17%) and Lockheed Martin (-0.66%) declined as analysts flagged delays in Pentagon contracts, and UPS (-1.44%) fell on guidance cuts tied to slower e-commerce demand.

All data current as of 2pm EST 04/15/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |