- Juniorstocks.com

- Posts

- Military Metals Uncovers 40.6% Antimony in Stockpile Samples, Wall Street Analysts Turn Bullish on Amazon, US Tariffs Strike Again

Military Metals Uncovers 40.6% Antimony in Stockpile Samples, Wall Street Analysts Turn Bullish on Amazon, US Tariffs Strike Again

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Military Metals Reports Spectacular Antimony-Gold Grades

Grab samples from the West Gore stockpile returned up to 40.6% antimony and 106.5 g/t gold, with averages of 17.94% Sb and 34.68 g/t Au, confirming the site's historic richness and modern potential.

CEO Scott Eldridge called the results “spectacular,” reinforcing confidence in the company’s exploration roadmap.

Drilling Campaign and Untested Targets Underway

These results follow the recent discovery of three high-priority drill targets, now central to an upcoming drill program aiming to expand the known deposit beyond historical workings.

This positions West Gore as a potential cornerstone domestic supply of critical minerals, especially antimony.

Nova Scotia’s Political Tailwinds Boost Strategic Relevance

Premier Tim Houston’s pro-mining policies, including fast-tracked approvals and lifting a 40-year uranium ban, create a favorable regulatory environment for resource development.

With China controlling 90%+ of the antimony market, West Gore’s high-grade results offer a national security and economic opportunity for Canada to reduce foreign dependency.

Wall Street is Bullish on Amazon (AMZN)

Wall Street Raises Targets as Amazon’s AI and Retail Engine Accelerates.

Needham’s Laura Martin raised her Amazon price target to $265, citing strong AWS revenue growth, record-breaking Prime Day sales, and significant logistics cost reductions and labor productivity gains driven by generative AI—factors she believes will support further share price appreciation.

Deutsche Bank’s Lee Horowitz increased his price target to $266, highlighting resilient consumer spending on Amazon, easing tariff concerns, and strong advertising revenue momentum, alongside AI-driven growth in AWS.

Both analysts agree that Amazon’s advances in AI, combined with operational efficiency and ongoing retail and cloud strength, are key to their elevated views and signal continued upside potential for the stock.

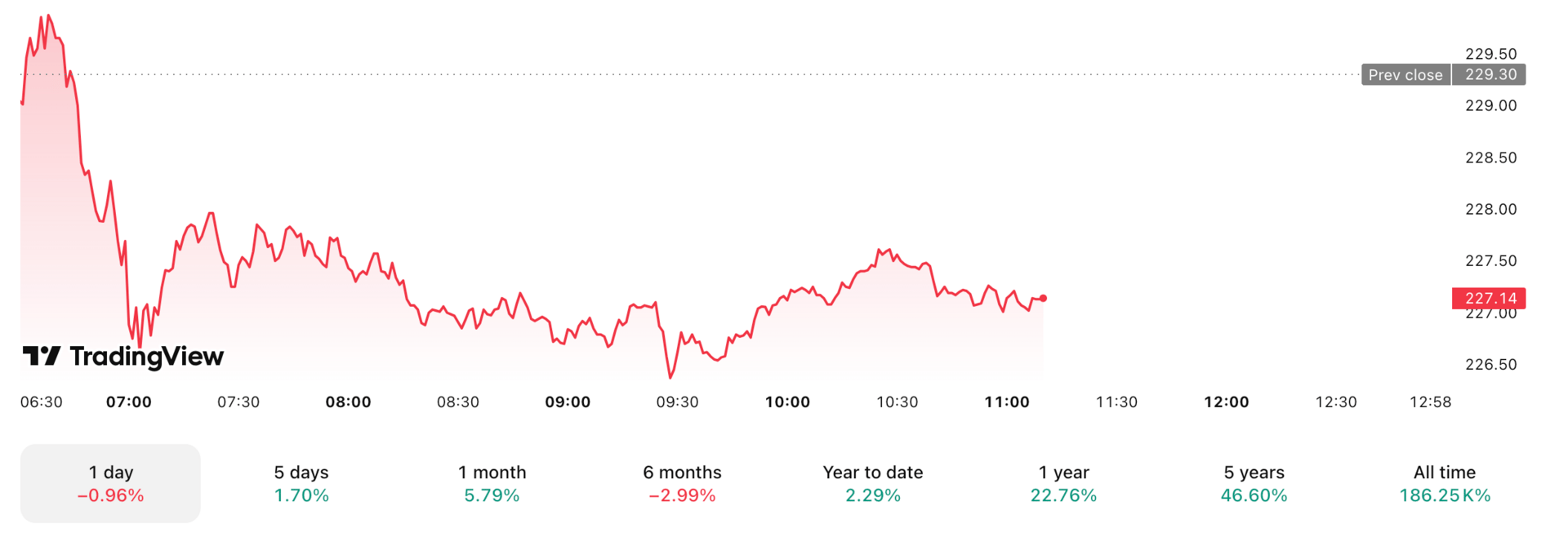

Amazon Stock Price ahead of July 31st Earnings Report

Market Snapshot Today:

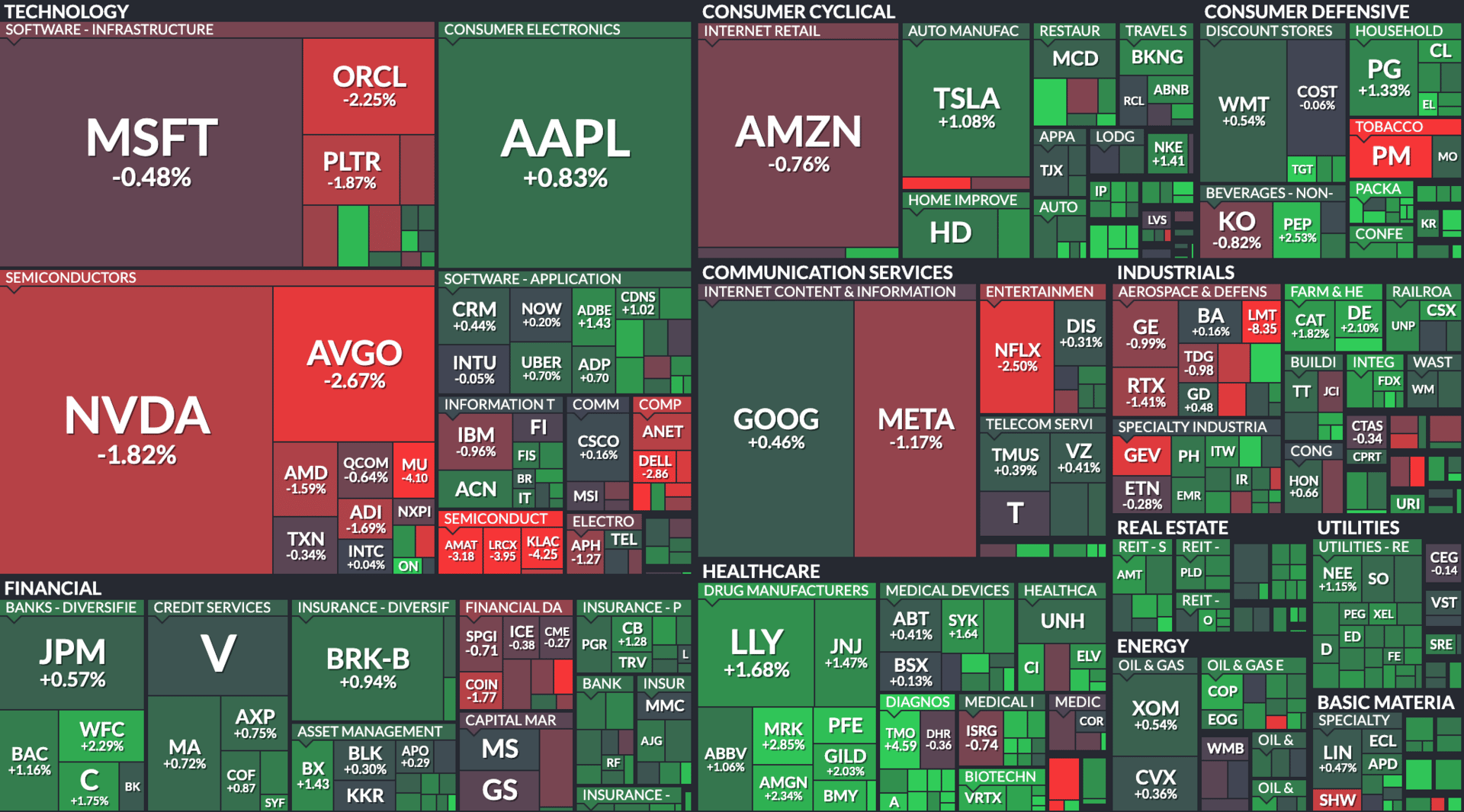

1. Tech & Semiconductors Under Pressure

NVIDIA (NVDA -1.82%), Broadcom (AVGO -2.67%), and Micron (MU -4.10%) saw declines amid concerns of chip supply chain disruptions and profit-taking after strong Q2 rallies. A recent analyst downgrade on Micron due to oversupply risks in DRAM/NAND likely accelerated the sell-off.

Software stocks like Oracle (ORCL -2.25%) and Dell (DELL -2.86%) also fell, possibly due to weak enterprise IT spending signals in recent earnings calls.

Healthcare & Pharma Rally

Eli Lilly (LLY +1.68%), Merck (MRK +2.85%), and Pfizer (PFE +2.03%) rose on the back of strong drug pipeline updates and positive sentiment around GLP-1 weight-loss treatments. Lilly in particular continues to benefit from obesity drug demand.

Thermo Fisher (TMO +4.59%) rallied on earnings optimism and potential M&A rumors in the diagnostics space.

3. Mixed Action in Consumer & Industrials

Tesla (TSLA +1.08%) and Nike (NKE +1.41%) gained as investors rotated back into consumer names following upbeat guidance and demand stabilization in China.

Meanwhile, Lockheed Martin (LMT -8.35%) plunged after posting disappointing earnings and issuing downbeat guidance on defense contract timing, dragging down peers like Raytheon (RTX -1.14%).

All data current as of 2pm EST 07/22/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |