- Juniorstocks.com

- Posts

- Military Metals' Golden Ticket, Crypto Treasuries: Untapped or Overhyped, EIB Opens its War Chest

Military Metals' Golden Ticket, Crypto Treasuries: Untapped or Overhyped, EIB Opens its War Chest

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

High-Grade Discovery at Strategic U.S. Site: Military Metals has completed its first fieldwork at the Last Chance Antimony Project in Nevada, uncovering high-grade surface samples (up to 11.61% stibnite) across a 1-km mineralized zone—just 18 km from Kinross’s Round Mountain gold mine.

Timing the Critical Minerals Boom: With antimony prices above $60,000/tonne and the U.S. urgently seeking domestic supply for defense and energy technologies, Military Metals is positioning itself as a key player in America’s critical mineral strategy, alongside peers like Perpetua Resources.

Rapid Growth + Upcoming Drilling: The company’s market cap surged over 8,700% in one year, hitting $41.95M, and it's now entering a drill-targeting and permitting phase—supported by NI 43-101 compliant assays and a strategic financing push via DGWA in Europe.

Crypto Treasuries: Untapped or Overhyped?

On @BloombergTV: I explain $STRK, $STRF, $STRD, the risk of shorting $MSTR, the rise of Bitcoin Treasury Companies, our 100% BTC @Strategy, debunk Quantum FUD, and show why AI is bullish for Bitcoin.

— Michael Saylor (@saylor)

5:08 PM • Jun 10, 2025

Wall Street Embraces On-Chain Assets: A new wave of funds is bringing crypto into the corporate treasury mainstream, with multiple spot crypto ETFs and structured funds now live on the NASDAQ- a clear signal that institutional finance is leaning into digital assets.

Built for Treasury, Not Just Trading: These funds aren’t just speculative tools. They’re being positioned as yield-generating, inflation-resistant treasury alternatives-ideal for companies looking to diversify USD-heavy balance sheets with programmable, liquid, and globally accessible assets.

Hype, Risk and First-Mover Advantage: From Bitcoin and Ether spot ETFs to tokenized T-bill strategies backed by stablecoins, capital is flowing into fully regulated, publicly-traded vehicles. But with that comes volatility, regulatory risk and uncertainty around long-term performance. For early adopters, the upside could be massive- but timing and risk tolerance matter.

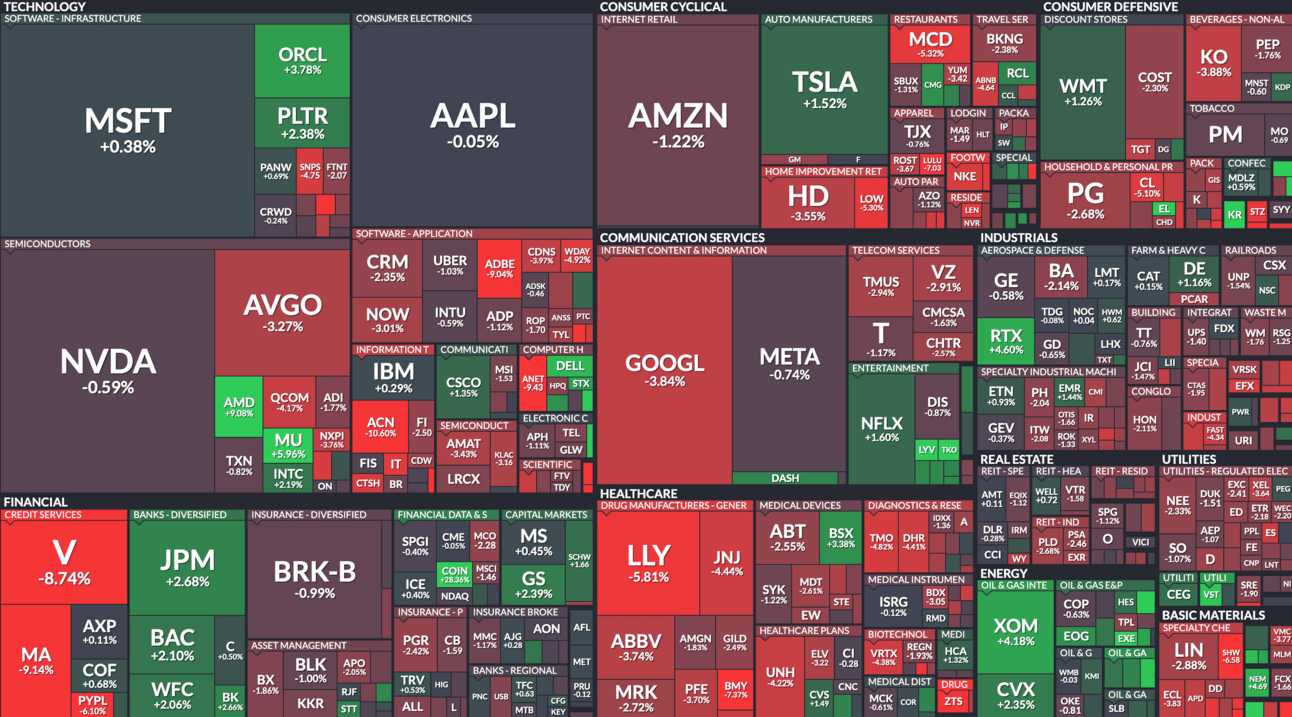

Market Snapshot This Week:

Semiconductor sector weakness after China-related chip concerns: Nvidia dipped (~0.6%) as renewed worries over U.S. export restrictions to China and alleged chip smuggling hit sentiment. Meanwhile, AMD surged +9% on strong AI chip momentum.

Visa’s stock tumble from stablecoin legislation fears: Visa fell ~9% after the U.S. Senate passed the GENIUS Act, which may let Walmart and Amazon issue stablecoins, threatening Visa's transaction fee model.

Mixed broader market reaction amid AI/crypto and Fed news: Nasdaq slipped ~0.4% on tech weakness, while crypto stocks rallied on stablecoin clarity. Tesla rose on robotaxi hype (~1.5%) and the Dow held firm on rate-cut optimism and financial sector support.

All data current as of 1pm EST 06/20/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |