- Juniorstocks.com

- Posts

- Mario Vetro's: Warrants to Wealth, Bitcoin Approaching All Time Highs, Rick Rule: Profit over Panic

Mario Vetro's: Warrants to Wealth, Bitcoin Approaching All Time Highs, Rick Rule: Profit over Panic

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

*This article was disseminated on behalf of Axcap Ventures Inc.*

Elite Financing Move: Vetro just pulled off a textbook capital markets flex—a $0.20 financing round with five-year full warrants (valued at $0.0664), locking in serious upside for investors. Fully subscribed, fully confident—this is fuel for a breakout.

Converse Is a Monster: Sitting on 5.57M oz M&I gold in Nevada’s Battle Mountain–Eureka Trend, Axcap is drilling hard with a fully funded 5,000m program targeting Goldstrike-style zones. No permitting issues, no metallurgy headaches—just raw scale and blue-sky potential.

Valuation Is Laughably Low: At even the most conservative NAV multiples, Axcap is trading miles below its intrinsic value. With insider buying, strategic liquidity, and a world-class asset, this is a re-rating setup in plain sight—and the market’s waking up.

What’s Powering Bitcoin’s Climb

Institutional adoption is accelerating

More public companies are adding Bitcoin to their balance sheets.

Strategy (MSTR) remains the largest corporate holder, setting the tone.

BTC is now seen less as a speculative asset, more as a strategic reserve.

Bitcoin is outperforming traditional hedges

CEO of Bitcoin Treasury Corp says BTC has outpaced gold as an inflation hedge.

In a high-debt, high-inflation macro environment, Bitcoin’s store-of-value thesis is gaining traction.

Regulatory clarity is lifting investor confidence

New U.S. legislation focused on stablecoins is signaling a maturing market.

Investors are responding to clearer frameworks with bullish momentum.

Technical outlook remains strong

BTC is trading near $109,000, approaching last month’s all-time high of ~$112,000.

Momentum remains bullish with institutional and retail inflows.

On @BloombergTV: I explain $STRK, $STRF, $STRD, the risk of shorting $MSTR, the rise of Bitcoin Treasury Companies, our 100% BTC @Strategy, debunk Quantum FUD, and show why AI is bullish for Bitcoin.

— Michael Saylor (@saylor)

5:08 PM • Jun 10, 2025

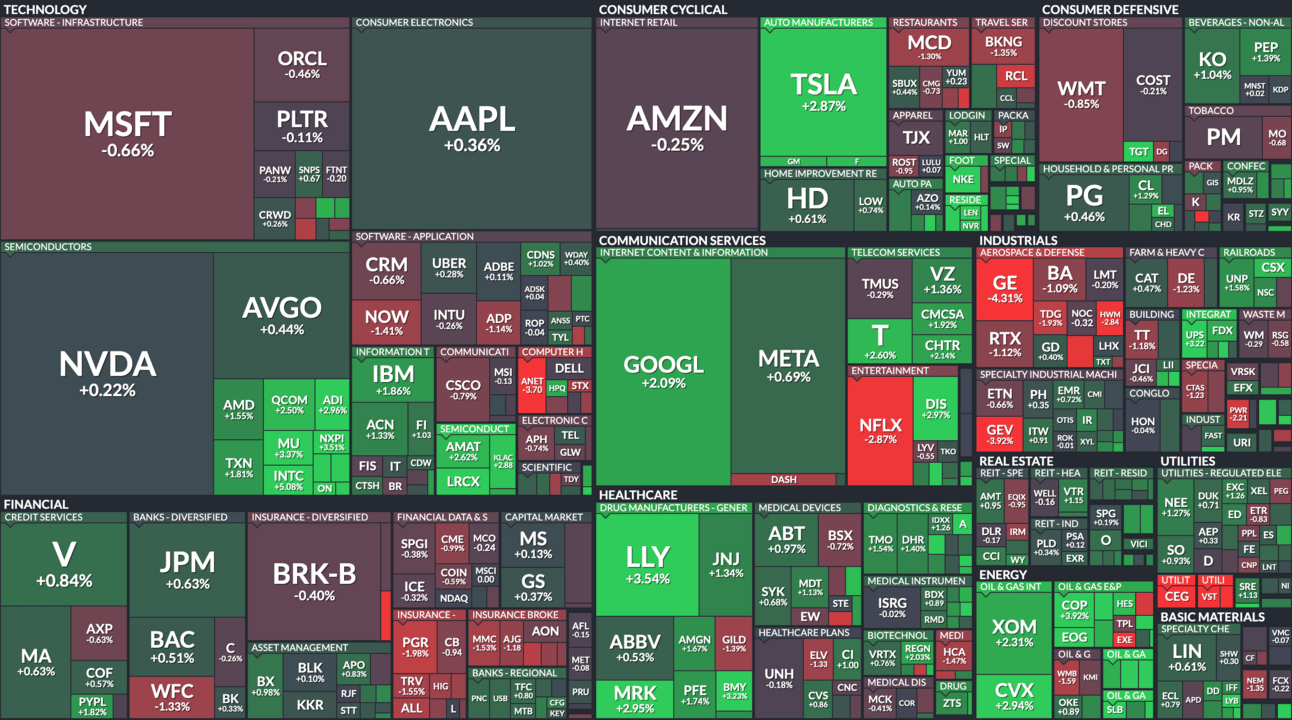

Market Snapshot This Week:

Energy: Exxon Mobil (XOM +2.31%) and Chevron (CVX +2.94%) rallied on optimism over crude oil market dynamics—seasonal demand and geopolitical tension have boosted WTI prices and both supermajors reported strong Q1 profits and robust upstream cash flow, fueling investor confidence.

Healthcare: Eli Lilly (LLY +3.54%) rose sharply after disclosing promising data on its ovarian cancer drug and continued to benefit from strong earnings estimates—analysts lifted their targets following upward revisions in its quarterly outlook.

Industrials: GE (GE Aerospace, down ~4.3%) plunged as Citigroup trimmed its price target and trading volume dropped significantly. Additionally, broader weakness in its industrial segments and investor concerns around GE Vernova’s earnings underperformance pressured the share price.

All data current as of 2pm EST 06/10/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |