- Juniorstocks.com

- Posts

- Keech's Canadian Call to Action, Trump's Tariff War Fallout, Deep-Sea Mining: Sink or Swim

Keech's Canadian Call to Action, Trump's Tariff War Fallout, Deep-Sea Mining: Sink or Swim

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Canada’s Untapped Resource Potential: Despite having vast reserves of oil, uranium, lithium, and critical minerals, Canada lags in resource development due to regulatory hurdles and political hesitation. By embracing its strengths and cutting red tape, the country could dominate the global resource sector instead of falling behind nations that maximize their natural wealth.

Energy & Mining: Unlocking Trillions in Economic Value - Building coast-to-coast pipelines and expanding domestic refining could keep billions in revenue within Canada. Fast-tracking LNG export terminals would position the country as a key energy supplier to Europe and Asia. The Ring of Fire holds a $1 trillion mineral opportunity, and Canada must take control of lithium, nickel, and critical mineral processing to lead in the EV revolution.

A Strategic Future: Sovereign Wealth & Arctic Security - Establishing a Canadian Sovereign Wealth Fund—like Norway’s—would ensure long-term economic stability by reinvesting resource profits. Strengthening Arctic sovereignty through military presence would protect access to strategic resources and secure Canada’s global standing. The path forward is clear—Canada must act now to transform into a global economic powerhouse.

Trump’s Tariff War: How It’s Shaking Up Wall Street

Impact of Trump’s Tariffs on Your Investment Portfolio

Markets Slide on Tariff News, Recover After Delay: U.S. stocks fell Monday as Trump announced 25% tariffs on Canadian and Mexican imports and 10% on Chinese goods. The S&P 500 dropped 1.8%, the Dow lost 570 points (1.5%), and the Nasdaq fell 2.2%. After Canada and Mexico agreed to tighten border policies, tariffs were delayed by a month, helping markets recover most of their earlier losses.

Goldman Sachs Sees S&P 500 Impact: Analysts at Goldman Sachs estimate tariffs could lower the S&P 500’s fair value by 5%, primarily through profit margin compression and weaker demand. They project a 2-3% reduction in S&P 500 earnings per share (EPS) if tariffs remain in place. A stronger U.S. dollar, supported by trade tensions, could further pressure corporate earnings, particularly for multinational companies. However, Canada and Mexico contribute less than 2% of S&P 500 revenues, limiting the direct impact.

Market Uncertainty Spikes: The U.S. Economic Policy Uncertainty Index surged to 502, its highest level since March 2020, reflecting heightened investor anxiety. Historically, uncertainty at this level has led to a 3% decline in the S&P 500’s forward price-to-earnings (P/E) ratio. Analysts expect the tariff-driven economic uncertainty to reduce risk appetite among investors. Treasury yields, particularly long-term bonds, remain largely unaffected, as inflation and economic slowdown concerns balance each other out.

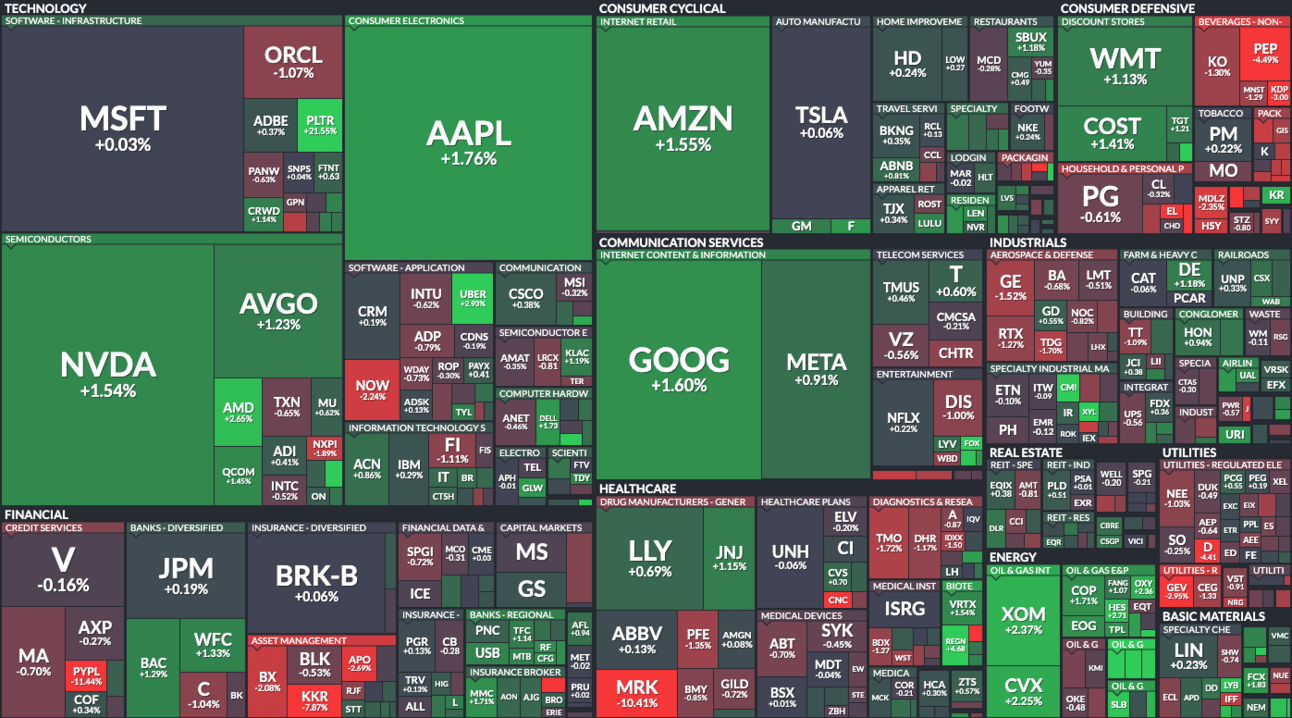

Market Snapshot Today:

Tech and Energy Drive Gains: Apple (AAPL) +1.76%, Nvidia (NVDA) +1.54%, and Google (GOOG) +1.60% led tech higher, while AMD +2.65% and AVGO +1.23% benefited from strong semiconductor demand. Energy stocks surged, with Exxon (XOM) +2.37% and Chevron (CVX) +2.25%, driven by rising oil prices.

Healthcare and Industrials Lag: Merck (MRK) -10.41% dragged healthcare down, possibly due to weak trial data. Boeing (BA) -1.50% and General Electric (GE) -1.52% struggled amid industrial uncertainty. Financials were mixed, with Blackstone (BX) -2.08% falling while JPMorgan (JPM) +0.19% stayed flat.

Market Rebounds Despite Volatility: Retail remained strong, with Walmart (WMT) +1.13% and Costco (COST) +1.41% reflecting stable consumer spending, while tech momentum continued to drive overall market optimism.

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |