- Juniorstocks.com

- Posts

- Snowline Sets the Stage in Yukon, S&P 500 Pushes to All-Time Highs, Bumble Swipes Left on Employees; Stock Flies

Snowline Sets the Stage in Yukon, S&P 500 Pushes to All-Time Highs, Bumble Swipes Left on Employees; Stock Flies

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

World-Class Gold Project: Snowline Gold’s first PEA for the Valley deposit in Yukon outlines a 20-year open-pit mine producing 6.8 million ounces of gold, with exceptionally low all-in sustaining costs ($569/oz first 5 years), yielding a post-tax NPV of C$3.37 billion at $2,150 gold and up to C$6.8 billion NPV at $3,150 gold.

Strong Market and Geological Positioning: The deposit boasts near-surface, high-grade mineralization, fast payback (2.7 years), and places Snowline among Canada’s largest undeveloped gold projects, driving an 11% share price surge and growing investor confidence.

Challenges Ahead: Despite strong economics, Snowline faces Yukon’s remote infrastructure challenges, pending Indigenous agreements, and high investor expectations that require flawless execution across technical, regulatory, and social fronts.

Markets Defy the Chaos: S&P Hits Records as Trade Peace and Strong Economy Drive Rally

Record Highs Despite Global Tensions: The S&P 500 hit a record high of 6,156, rising 0.3% on Friday and gaining over 5% in the past month, even amid U.S.-China trade tensions and conflict in the Middle East.

Tariff Easing Fuels Rally: Markets surged as President Trump rolled back major tariffs, culminating in a U.S.-China trade deal that slashed duties and improved investor sentiment, helping the Nasdaq jump 28% and the Dow gain 12% since April lows.

Economic Resilience Sustains Optimism: Despite earlier fears, the economy shows low inflation, steady hiring and recovery from Middle East turmoil, keeping Wall Street optimistic about continued growth.

High Stakes Ahead: With markets brushing off global tensions, the path forward remains uncertain — it could either push to new highs or all come crashing down depending on President Trump’s next X post.

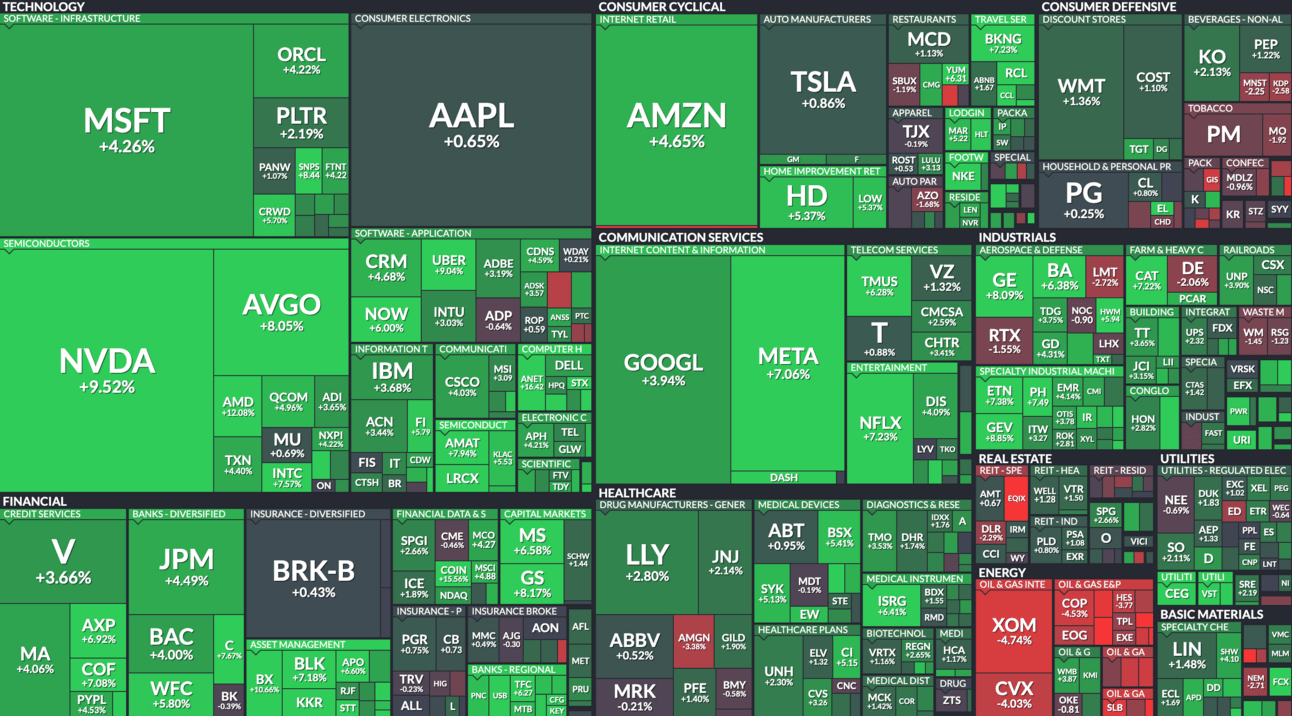

Market Snapshot This Week:

Tech & AI Boom Lifts Big Names: NVDA (+9.52%) and AMD (+12.08%) surged on continued AI optimism and reports of record GPU demand from cloud and enterprise customers. MSFT (+4.26%) and META (+7.06%) rallied alongside, driven by investor confidence in AI infrastructure spending and strong advertising trends.

Financials Climb as Rate-Cut Bets Cool Off: JPM (+4.49%), GS (+8.17%), and BX (+10.66%) gained as economic data suggested the U.S. economy remains resilient, softening expectations for immediate Fed rate cuts. This helps banks’ net interest margins and boosts asset managers exposed to equities.

Energy Slumps on Falling Oil Prices: XOM (-4.74%) and CVX (-4.03%) declined as oil prices retreated on rising U.S. inventories and weaker-than-expected demand signals from China, pressuring the energy sector despite broader market strength.

All data current as of 2pm EST 06/27/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |