- Juniorstocks.com

- Posts

- Israel-Iran: Defense Stocks to Keep an Eye on, Coinbase: the Key for Sonic, Market Unfazed by Possible WW3

Israel-Iran: Defense Stocks to Keep an Eye on, Coinbase: the Key for Sonic, Market Unfazed by Possible WW3

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Major contractors like Lockheed Martin (LMT), RTX Corp (RTX), and Northrop Grumman (NOC) are positioned for growth as demand surges for fighter jets, missile systems, and cyber defense amid rising Middle East tensions. U.S. defense spending for 2025 has risen to $923.3B, supporting long-term tailwinds.

Military Metals Corp (OTCQB: MILIF | CSE: MILI) is an emerging high-risk, high-reward play, surging 8,700% in market cap due to antimony exposure—a critical metal for defense tech—just as antimony prices hit all-time highs and supply chains tighten.

Geopolitical risks could boost defense demand but also increase market volatility; while blue-chip defense stocks offer relative stability, small-caps like Military Metals carry speculative upside with greater sensitivity to conflict-driven news.

Stocks Roaring Despite Tariff and Geopolitical Questions

S&P 500 hit a 4-month high near 6,100, gaining 1.2% Tuesday as investors responded to easing geopolitical risk. Reports of a U.S.–Iran ceasefire and Iran backing off threats to close the Strait of Hormuz pushed Brent crude oil down 6% to $67/barrel, helping restore confidence in global trade flows.

Optimism on tariffs and rate cuts grew as U.S. inflation remains contained and signs emerged that the Biden administration may ease some China tariffs. Goldman Sachs raised its S&P 500 six-month target, citing faster earnings growth and a more stable macro outlook.

Q1 earnings came in strong, with ~78% of S&P 500 companies beating estimates and EPS up ~13% YoY. The Dow jumped 500 points and the Nasdaq surged 1.5%, reflecting broad-based investor confidence despite lingering recession fears.

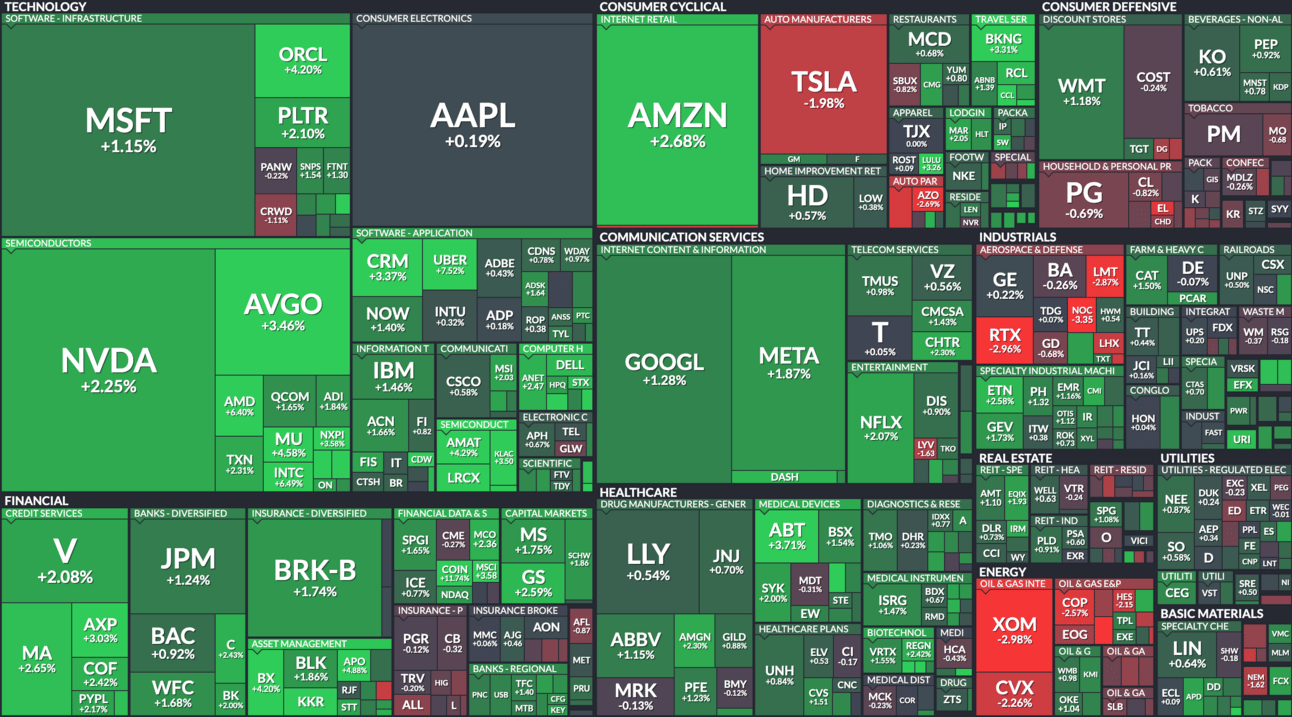

Market Snapshot This Week:

Tech & Semiconductors surged (e.g., AMD +6.4%, NVDA +2.3%, AVGO +3.5%): Stocks rallied on renewed hope for a ceasefire between Israel and Iran—boosting risk-on sentiment—and upbeat analyst upgrades for chipmakers like AMD and Broadcom, with the PHLX Semiconductor Index jumping ~3.6%.

Energy names dropped sharply (XOM −2.98%, CVX −2.26%): Oil prices declined over 5–6% as Middle East supply fears eased, causing major oil stocks to fall despite mixed Q1 results and shorter-term profit outlooks .

Industrials and airlines rose (e.g., UAL, DAL up ~3–4%): The same relief in oil-markets and improved geopolitical outlook lifted airline and broader industrial sectors, as investors rotated into economically sensitive plays.

All data current as of 2pm EST 06/24/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |