- Juniorstocks.com

- Posts

- U.S. Strikes Back, Silver & Copper Surge: Key Drivers, Bitcoin Crushes All-Time High

U.S. Strikes Back, Silver & Copper Surge: Key Drivers, Bitcoin Crushes All-Time High

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Pentagon Invests $400M in MP Materials: The U.S. Department of Defense became MP Materials’ largest shareholder, signaling a major push to secure domestic rare earth supply chains critical for advanced weapons and technology. MP’s stock soared over 50% on the news.

Strategic National Security Move: MP Materials, owner of America’s only rare earth mine, is building a new “10X” magnet plant to produce 10,000 metric tons annually by 2028. The Pentagon backs the project with equity, a $110/kg price floor for NdPr magnets, and a $150M loan to expand processing capacity.

Blueprint for Future Resource Independence: The deal marks a historic shift in U.S. industrial policy, blending national defense and private investment. It signals America’s determination to reduce reliance on China for critical minerals vital to defense systems, EVs, and tech industries.

Silver and Copper Prices Surge: Key Drivers Behind Recent Highs

Silver prices have surged to a 13-year high ($38.34/oz), up 5.5% in the past month and 24% year-on-year, driven by strong industrial demand and investor interest.

The rally is fueled by booming demand from green technologies—especially solar panels and electric vehicles—as well as persistent supply deficits. Industrial use now accounts for nearly 60% of total silver consumption, and mine supply has struggled to keep pace with this growth. Investors are also turning to silver as a hedge against inflation and economic uncertainty, further boosting prices.

Copper remains strong at $5.56/lb, up nearly 15% in a month and 21% over the past year, supported by tight inventories and demand from the EV and renewable energy sectors.

The price surge is mainly due to the global push for electrification, which has sharply increased copper demand for electric vehicles, renewable energy infrastructure, and grid modernization. At the same time, supply growth has lagged because of mining disruptions, lower ore grades, and political instability in key producing countries, creating a supply-demand imbalance.

Both metals are outperforming broader commodity indices, reflecting robust fundamentals and ongoing supply constraints.

The combination of accelerating industrial demand, persistent supply shortages, and strong investment flows has created a perfect storm for higher prices in both silver and copper, with the clean energy transition acting as a powerful long-term tailwind.

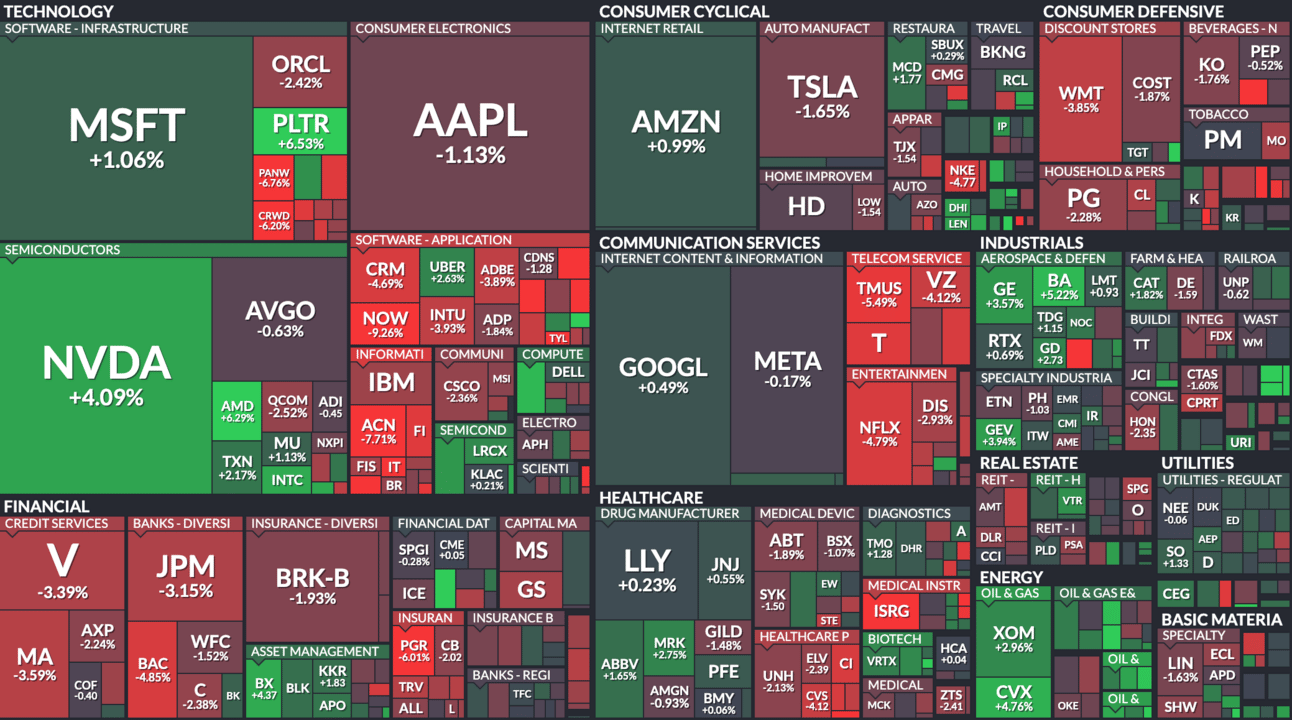

Market Snapshot This Week:

Semiconductors Surge, Led by NVDA (+4.09%) and AMD (+6.29%): Chipmakers rallied as new AI-related product announcements and stronger-than-expected data center demand boosted sentiment. Analysts raised price targets on Nvidia and AMD following reports of large pre-orders for next-gen AI accelerators and optimism about long-term semiconductor growth tied to generative AI infrastructure.

Software & Consumer Giants Mixed: MSFT Up (+1.06%), AAPL Down (-1.13%), NOW Tumbles (-9.26%): Microsoft rose on sustained AI integration news, while Apple slipped after reports of softer iPhone demand in parts of Asia. ServiceNow (NOW) plunged over 9% as the company issued cautious forward guidance, citing macro headwinds in enterprise software spending and longer sales cycles.

Industrials & Energy Gain, Retail Weakens: WMT Down (-3.85%), BA Up (+5.22%), CVX Up (+4.76%): Boeing jumped on news of fresh aircraft orders and signs that production issues were being resolved. Energy stocks like Chevron rallied with oil prices rising on Middle East tensions and OPEC+ maintaining production cuts. Walmart sank nearly 4% amid concerns about softer consumer spending trends and margin pressures from rising shrink and wage costs.

All data current as of 1pm EST 07/08/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |