- Juniorstocks.com

- Posts

- Drill, Baby, Drill: Converse Unveils Gold Upside, War Fears Drag Indexes, BMO Turns Bullish on Metals

Drill, Baby, Drill: Converse Unveils Gold Upside, War Fears Drag Indexes, BMO Turns Bullish on Metals

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Disseminated on behalf of Axcap Ventures Inc.*

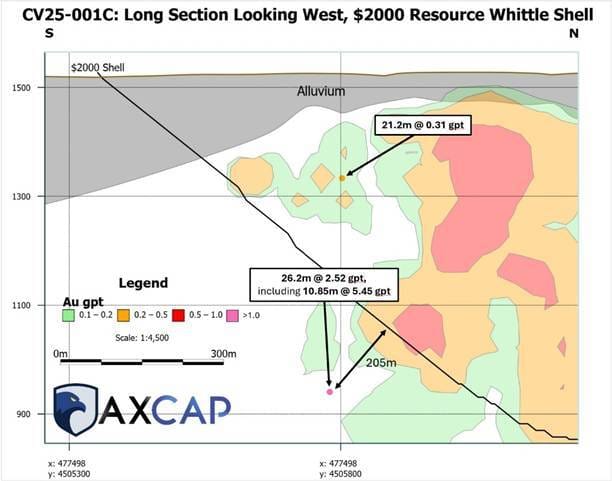

Axcap’s first drill hole at the Converse Project revealed a new high-grade zone (5.45 g/t over 10.85m) beneath the known deposit—potentially transforming the project from a low-grade open pit to a hybrid, higher-margin asset.

The initial hole hit all three targets: confirmed the resource, reduced strip ratio, and uncovered new deeper mineralization. Even shallow intercepts returned multi-element results (gold, silver, copper), adding polymetallic potential and strategic optionality.

Figure 1: Long-Section Through Converse - Looking West

With a 5.9Moz gold resource modeled conservatively at $2,000/oz gold, and more assays pending, Axcap is just getting started. The combination of robust geology, structural controls, and disciplined QA/QC makes Converse a serious contender in Nevada’s next wave of gold discoveries.

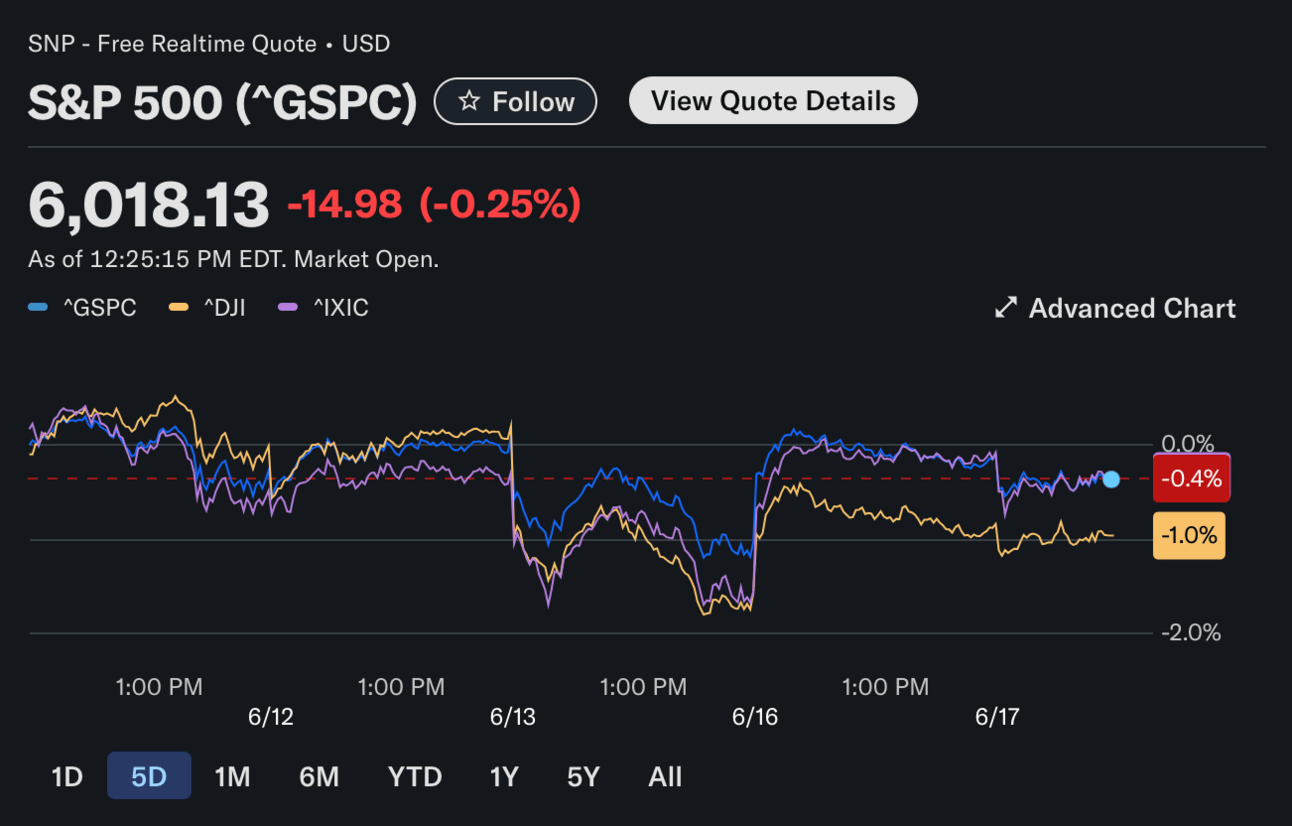

Middle East Conflict, Consumer Weakness and the Fed

Middle East conflict escalates: Trump’s call for the evacuation of Tehran and rejection of a ceasefire spooked markets. With over 50 Israeli airstrikes reported overnight and Brent rising above $75, energy traders priced in the risk of broader regional war, pushing WTI crude up +2.42%.

Consumer weakness emerges: US retail sales fell -0.9% in May, vs. -0.2% expected — the sharpest monthly drop since March 2023. This suggests demand softening ahead of Trump’s tariff reimplementation, raising concerns about near-term economic resilience.

Fed policy in limbo: With the Fed expected to hold rates steady Wednesday, markets are parsing signals for future cuts. Core PCE inflation has fallen to 2.6% YoY, but sticky services inflation and geopolitical uncertainty may delay easing, weighing on equities.

Market Snapshot Today:

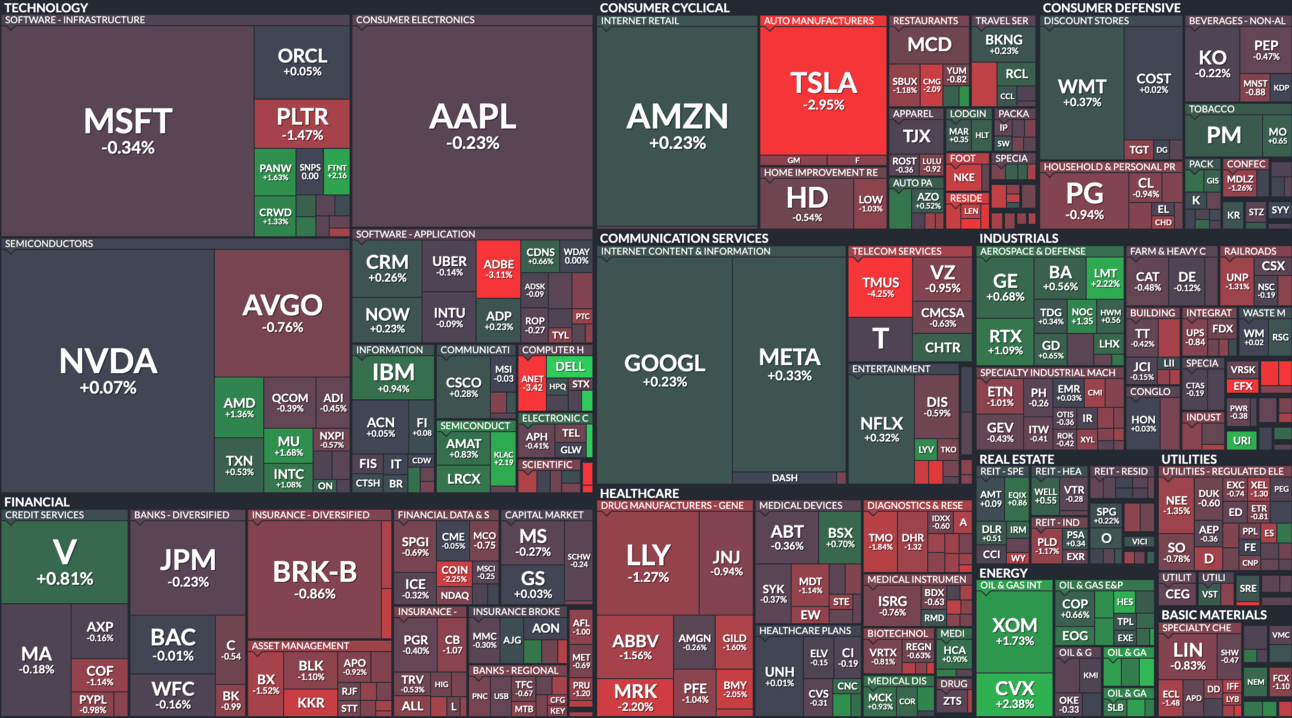

Tech Mixed; Semiconductors Resilient: Despite weakness in major names like Palantir (-1.47%) and Adobe (-3.11%), semiconductors held strong with AMD (+1.36%) and MU (+1.68%) rising. This reflects bullish momentum in AI and chip demand, supported by recent reports of new high-performance GPU shipments and sustained enterprise investment in data infrastructure.

Tesla, Healthcare Drag Down Indexes: Tesla plunged (-2.95%) amid reports of EV demand softening in China and delays in the launch of its Robotaxi initiative. Meanwhile, healthcare underperformed across the board—Eli Lilly (-1.27%), Merck (-2.20%), AbbVie (-1.56%)—as investors rotated out of defensives and pricing pressure concerns re-emerged ahead of U.S. election debates on drug reform.

Energy and Defense Outperform: Oil majors like Chevron (+2.38%) and ExxonMobil (+1.73%) rallied on the back of a crude oil price spike above $86/barrel, driven by Middle East tensions and summer demand forecasts. In defense, Lockheed Martin (+2.22%) and Northrop Grumman (+1.06%) saw gains following the announcement of a $10B Pentagon contract focused on advanced missile systems.

All data current as of 12pm EST 06/17/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |