- Juniorstocks.com

- Posts

- China's Metal Ban, Political Unrest & Insider Buys

China's Metal Ban, Political Unrest & Insider Buys

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

China’s recent export ban of Antimony, Germanium and Gallium has led to the following:

Canadian Companies Step Up Amid China's Metal Ban: Following China’s export restrictions on critical metals like gallium, germanium, and graphite, Canadian firms such as Teck Resources, Neo Performance Materials, and Northern Graphite are rising to fill supply gaps for high-tech and energy industries in North America.

Key Players and Efforts in Critical Minerals: Neo Performance Materials is North America’s sole gallium producer, leveraging recycling to meet semiconductor industry demands. Teck Resources leads in germanium production, while Northern Graphite operates North America’s only active graphite mine, crucial for energy storage technologies.

Challenges Ahead for Canadian Producers: While the ban creates opportunities, Canadian firms face hurdles like potential U.S. tariffs, price resistance from buyers, and the need to scale up production to secure a larger share of the global market.

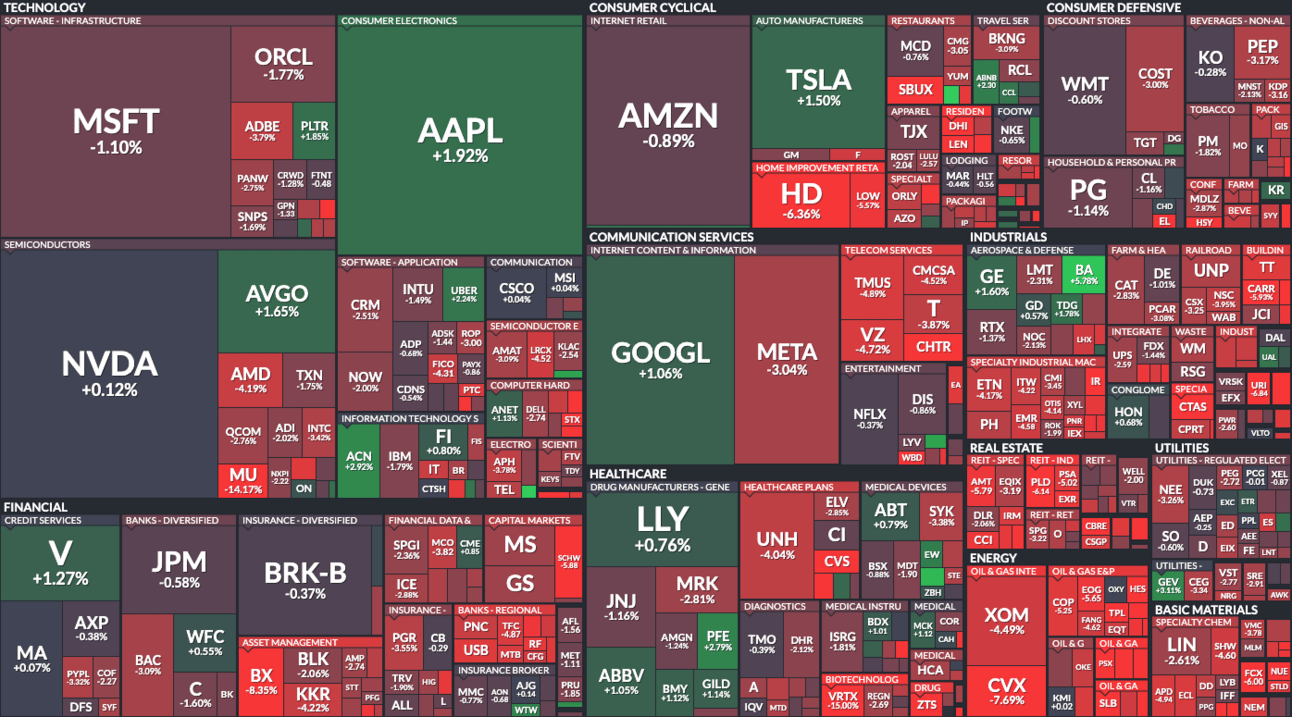

Market Snapshot:

U.S. Markets Experience Significant Declines: The S&P 500 and Dow Jones Industrial Average both saw substantial drops, with the Dow enduring a 10-day losing streak, its longest since 1974. This downturn was influenced by the Federal Reserve's announcement indicating fewer interest rate cuts in 2025, leading to investor concerns about prolonged higher borrowing costs.

Tech Stocks Attempt Recovery Amidst Volatility: The "Magnificent Seven" tech giants, including Apple, Nvidia, and Tesla, showed signs of recovery towards the end of the week. This movement followed the release of lower-than-expected inflation data, which temporarily boosted investor sentiment. However, the overall market remained cautious due to potential government shutdowns and the Federal Reserve's stance on interest rates.

Technical Analysis - Bitcoin

All-Time High and Subsequent Correction: On December 16, Bitcoin reached a new all-time high of approximately $108,267. This peak was followed by a sharp correction, with prices declining to around $92,263 by December 20, indicating a volatile trading environment.

Support and Resistance Levels: The psychological resistance at $100,000 played a pivotal role during this period. After breaching this level, Bitcoin faced selling pressure, leading to a pullback. Support was observed near the $90,000 mark, suggesting a consolidation phase as traders assessed market conditions.

Macroeconomic Events: The Federal Reserve's announcement of a 25 basis point interest rate cut on December 18 influenced market sentiment. While such cuts can boost risk assets, the Fed's cautious outlook led to increased market uncertainty, contributing to Bitcoin's price volatility.

Data current as of 12/20/2024 12pm EST

Top Viewed Articles this week:

Insider Buys:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |