- Juniorstocks.com

- Posts

- Trump vs. The Fed, Steel Short Squeeze, Ukraine Bargains with Rare Earth's

Trump vs. The Fed, Steel Short Squeeze, Ukraine Bargains with Rare Earth's

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Trump vs. The Fed: Former President Donald Trump has renewed his calls for aggressive interest rate cuts, arguing that high rates stifle economic growth. His ongoing criticism of Federal Reserve Chair Jerome Powell has fueled speculation about potential challenges to the Fed’s independence if Trump is reelected.

Market Volatility & Bitcoin’s Struggles: The Federal Reserve's pause on rate cuts, amid hotter-than-expected inflation data, has led to significant market reactions. Bitcoin, which previously benefited from lower rates, has tumbled, while gold has surged to all-time highs, highlighting uncertainty in financial markets.

Calls to Restructure the Fed: Figures like Elon Musk and Ron Paul have amplified discussions about reforming or even dismantling the Federal Reserve. With growing political pressure and economic uncertainty, the Fed faces a tough balancing act between controlling inflation and addressing demands for rate cuts.

Steel Showdown: Tariffs Ignite Short Squeeze in U.S. Stocks

Wall Street Braces for Volatility as Traders Rush to Cover Bearish Bets

Tariffs Driving Short Covering and Volatility: The 25% tariffs on steel and aluminum imports by the Trump administration could force short sellers to cover positions in U.S. steel stocks, while increasing short selling pressure on international metal stocks. S3 Partners states this dual pressure could create momentum swings, adding volatility to the $1.92 trillion global Metals & Mining industry.

High Short Interest in U.S. Steel Stocks: U.S. Steel (X) has $805 million in short interest, representing 9.2% of its float, while Nucor (NUE) has $754 million (2.3%) and Carpenter Technology (CRS) has $500 million (5.7%). These three companies alone account for over $2 billion in short positions, suggesting potential short squeezes if stock prices rise.

Rising Bearish Bets Despite Tariff Tailwinds: Over the past 30 days, Nucor's short interest increased by $61 million (+8.8%) and Carpenter Technology's by $49 million (+10.9%), signalling that bearish sentiment persists despite tariffs. This reflects uncertainty about whether protectionist policies will drive long-term gains for domestic steelmakers.

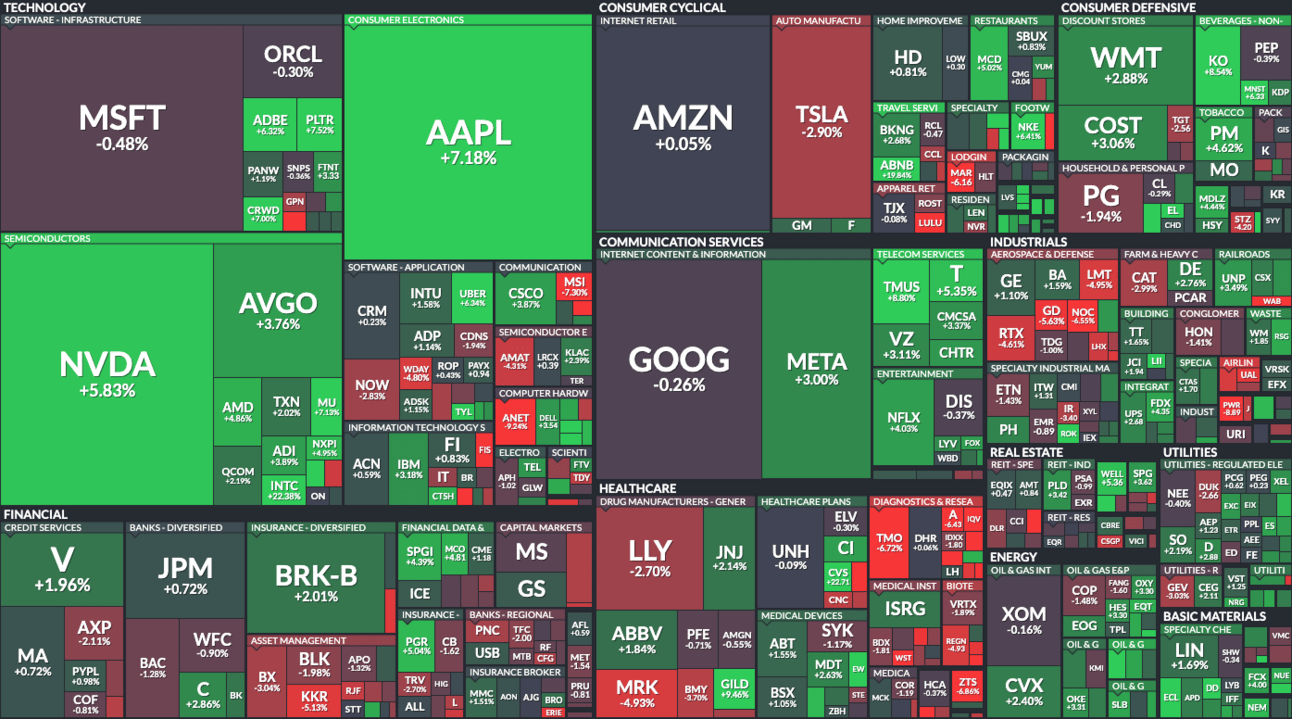

Market Snapshot This Week:

Technology and Semiconductors Lead Gains: The technology sector, particularly semiconductor stocks, performed well, with NVIDIA (NVDA) up +5.83%, Broadcom (AVGO) up +3.76%, and AMD up +4.86%. This indicates strong investor confidence in the AI and chip industry.

Mixed Sentiment in Mega-Cap Stocks: While Apple (AAPL) surged +7.18%, Microsoft (MSFT) declined -0.48%, and Google (GOOG) dipped -0.26%, showing varied performance among the biggest tech players. Meta (META) gained +3.00%, suggesting strength in social media and advertising.

Tesla and Healthcare Struggles: Tesla (TSLA) dropped -2.90%, reflecting weakness in the auto sector, while Eli Lilly (LLY) fell -2.70% and Merck (MRK) declined -4.93%, signalling pressure on major healthcare stocks.

All data current as of 1pm EST 02/14/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |