- Juniorstocks.com

- Posts

- Buffet Does it AGAIN, Market Bottom: NASDAQ Stocks Rallying, Heavy Metal Politics

Buffet Does it AGAIN, Market Bottom: NASDAQ Stocks Rallying, Heavy Metal Politics

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Buffett’s $334 billion cash reserve: Initially criticized as overly cautious, it proved strategically brilliant after markets slumped due to Trump’s tariffs, positioning Berkshire Hathaway to capitalize on falling asset prices.

Patience and disciplined capital deployment: Buffett viewed cash not as fear-driven hoarding but as a flexible tool for future investment in fundamentally strong American businesses.

Belief in imaginative capitalism: Amid market turbulence and recession fears, Buffett emphasized investment during uncertain times, reinforcing his long-term vision and confidence in economic resilience.

Your turn! Was Buffett’s massive cash reserve a strategic masterstroke or just cautious luck? Share your perspective on LinkedIn and connect with investors discussing the Oracle of Omaha’s latest moves.

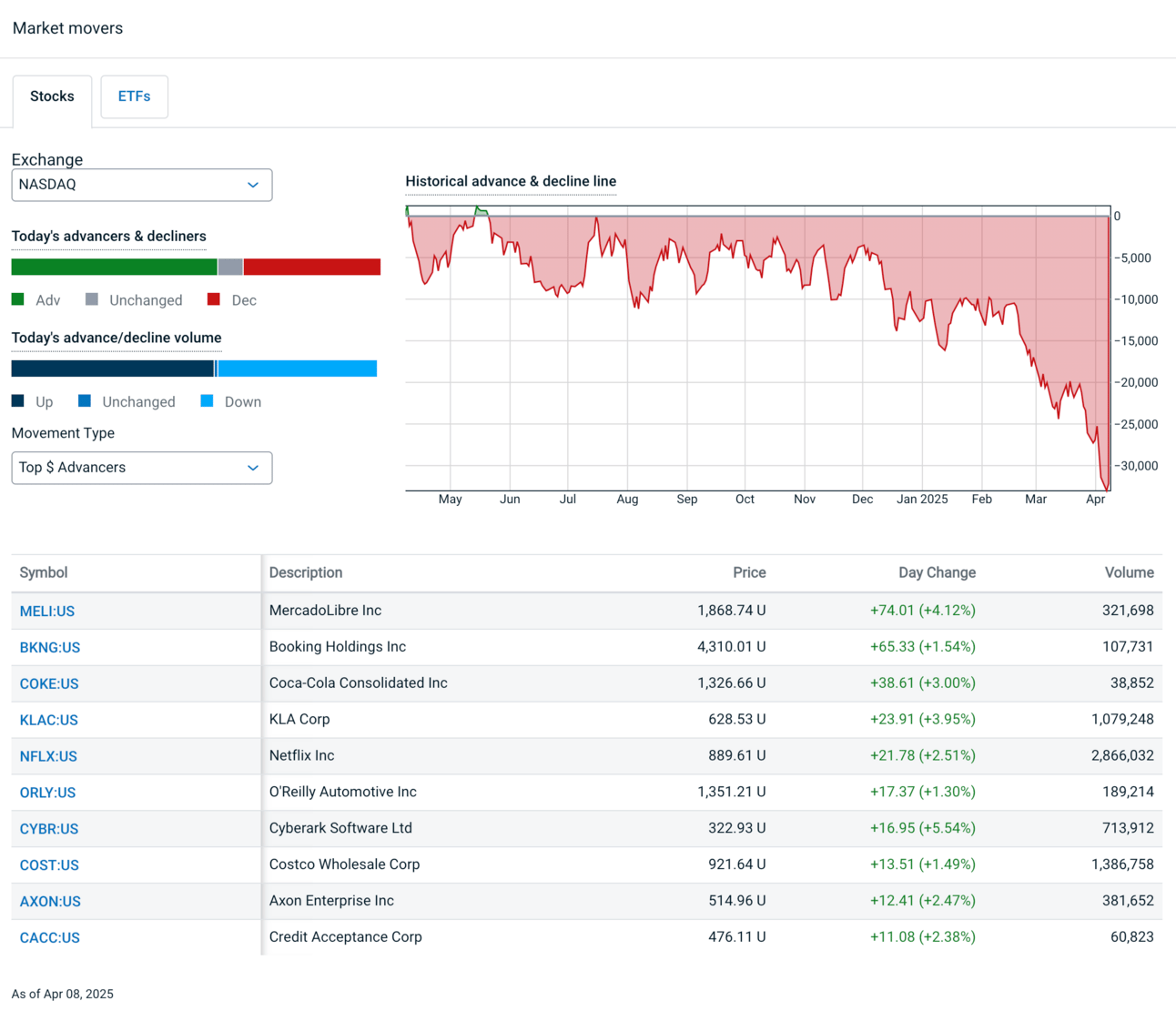

Bottom In? Markets Bounce on News of Tariff Negotiations.. The NASDAQ’s Biggest Movers

Renewed trade hopes fuel a market comeback — these NASDAQ standouts are leading the charge.

Top NASDAQ Advancers by Dollar Amount today:

MercadoLibre Inc (MELI:US): $1,868.74 | +$74.01 (+4.12%)

Booking Holdings Inc (BKNG:US): $4,310.01 | +$65.33 (+1.54%)

Coca-Cola Consolidated Inc (COKE:US): $1,326.66 | +$38.61 (+3.00%)

KLA Corp (KLAC:US): $628.53 | +$23.91 (+3.95%)

Netflix Inc (NFLX:US): $889.61 | +$21.78 (+2.51%)

O'Reilly Automotive Inc (ORLY:US): $1,351.21 | +$17.37 (+1.30%)

Cyberark Software Ltd (CYBR:US): $322.93 | +$16.95 (+5.54%)

Costco Wholesale Corp (COST:US): $921.64 | +$13.51 (+1.49%)

Axon Enterprise Inc (AXON:US): $514.96 | +$12.41 (+2.47%)

Credit Acceptance Corp (CACC:US): $476.11 | +$11.08 (+2.38%)

Top 10 Volume on the NASDAQ April 8, 2025

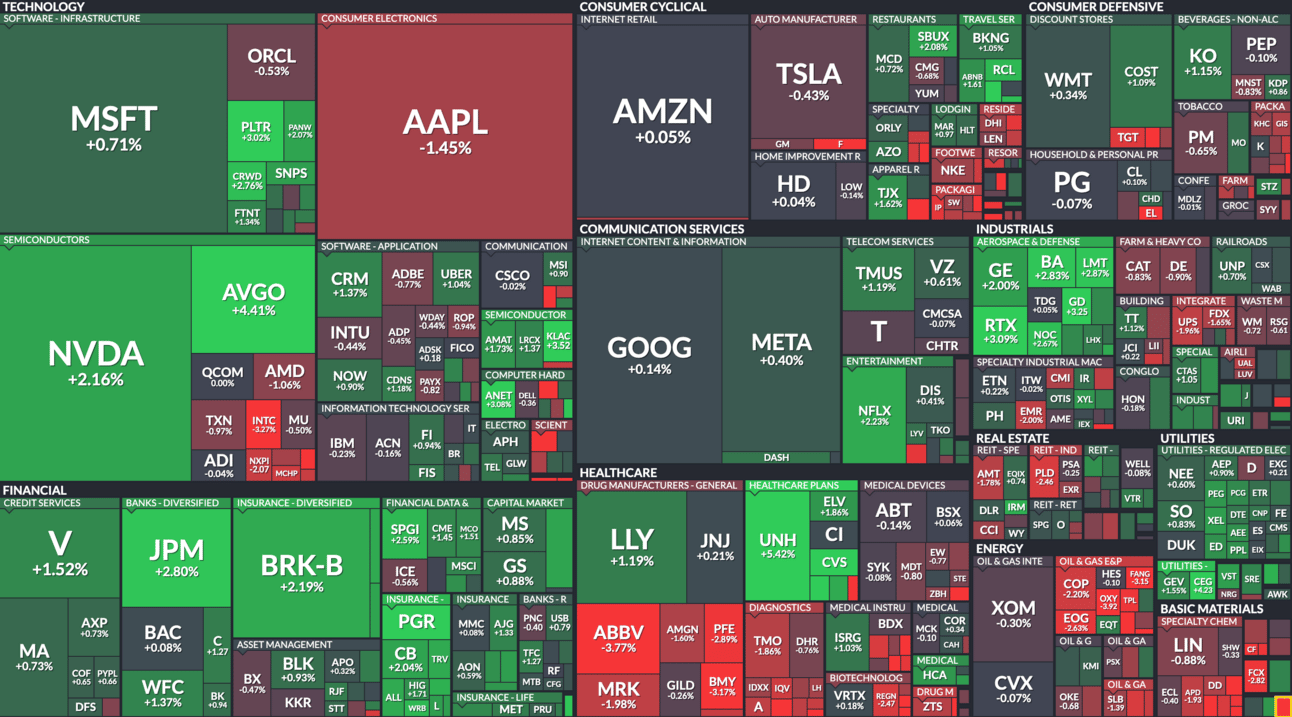

Market Snapshot Today:

Cruise Line Stocks Surge: Norwegian Cruise Line (NCLH), Carnival (CCL), and Royal Caribbean (RCL) experienced significant stock price increases after announcing new partnerships and charter deals, signaling strong future demand in the travel industry.

Healthcare Stocks Rally: Companies like Humana (HUM), CVS Health (CVS), and UnitedHealth Group (UNH) saw their stock prices rise following the Centers for Medicare & Medicaid Services' decision to increase Medicare Advantage payments, which is expected to boost revenues for these insurers.

Tech Stocks Rebound Amid Tariff Tensions: Despite ongoing U.S.-China tariff disputes, tech giants such as Nvidia (NVDA), Palantir (PLTR), Apple (AAPL), and Tesla (TSLA) experienced stock price recoveries. This resilience suggests investor optimism about the tech sector's ability to withstand trade-related challenges.

All data current as of 1pm EST 04/08/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |