- Juniorstocks.com

- Posts

- Nevada's Gold Rush, American Defense Playbook and Crypto is Mainstream?

Nevada's Gold Rush, American Defense Playbook and Crypto is Mainstream?

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Disseminated on behalf of Axcap Ventures Inc.

Major Gold Resource + PEA Catalyst: Axcap has launched a long-awaited Preliminary Economic Assessment (PEA) for its 100%-owned Converse Gold Project, hosting 6.18 million ounces (M&I) and 1.69 million ounces (inferred)—making it one of the largest undeveloped gold deposits in the U.S. This comes as gold prices surge above $3,350/oz, offering a powerful macro backdrop.

Nevada M&A Surge Signals Re-Rating Potential: AngloGold Ashanti’s $197 million acquisition of Augusta Gold highlights intense M&A activity in Nevada. With Axcap trading at just $5/oz versus peers like K92 Mining at $80–$100/oz, AXCP is significantly undervalued and could be a prime takeover target.

Strong Insider Confidence & Low Valuation: Over $1 million in insider buying, 96 million shares locked up, and a market cap of just $34.85 million at $0.105/share reflect strong internal conviction—positioning Axcap as a high-upside opportunity in a rising gold market.

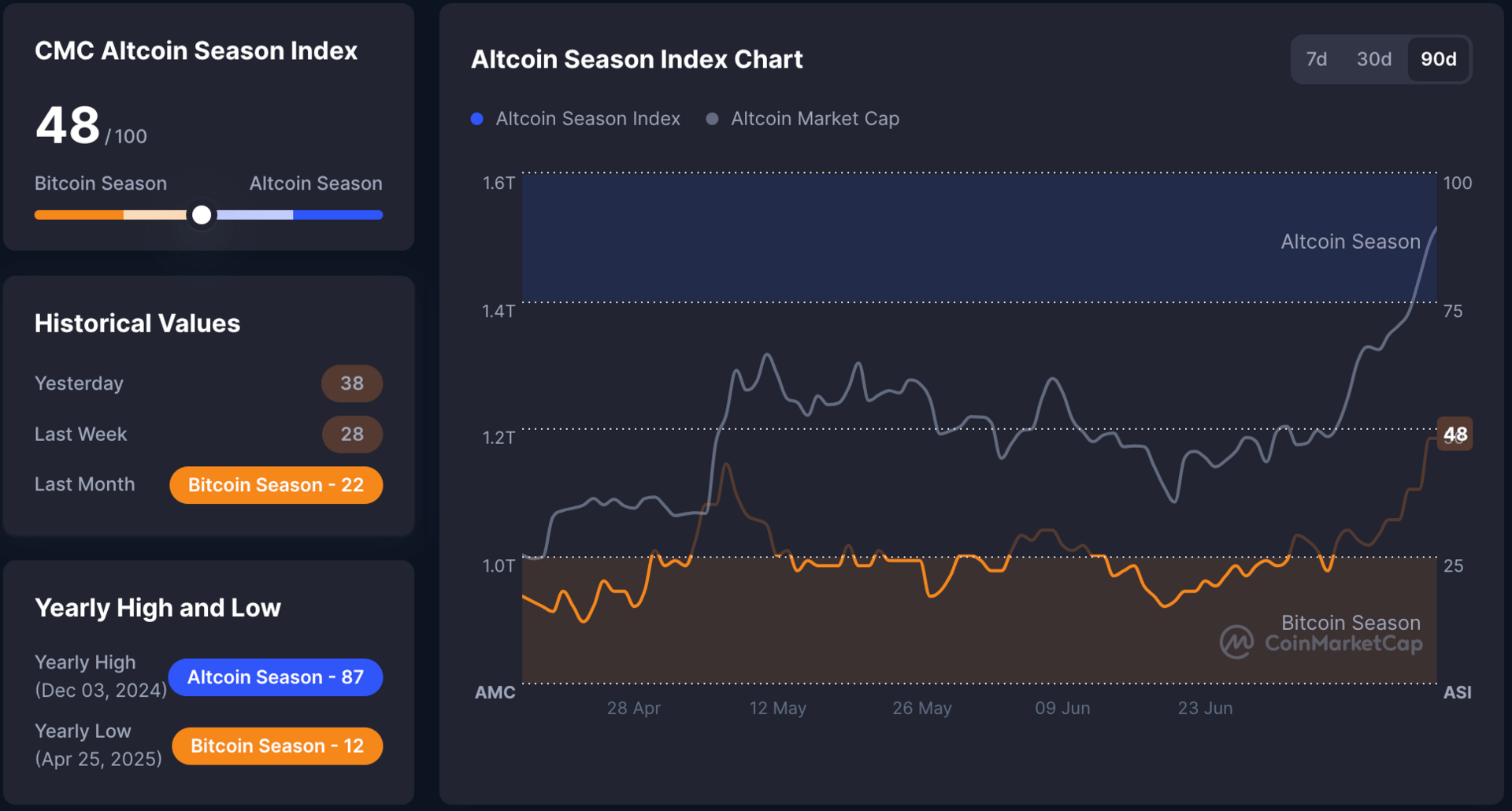

Crypto Shifts from Bitcoin Season to Altcoin Season

Bitcoin dominance is falling, signaling capital rotation to altcoins: Bitcoin's share of the overall crypto market dropped from a peak of 65.4% in May to 61.5% in mid-July, the lowest since April. This drop is a classic signal that alt-season is underway, as capital flows out of Bitcoin into other cryptocurrencies.

Altcoins are outperforming Bitcoin, with broad double-digit gains: The altcoin market capitalization (TOTAL2) has surged 44% since June, reaching $1.5 trillion. Many altcoins posted weekly gains of 10–20%, with standout tokens like ETH rallying 44% and others like SUI, IP, and ENA showing strong momentum. Rising Altcoin Season Index levels further confirm marketwide outperformance.

Data-backed market transition confirmed by institutional flows: July saw large net inflows into Ethereum ETFs, and CoinDesk’s broader CD20 altcoin index has outperformed major coin benchmarks. Analysts highlight robust capital rotation, increased volume, and expanding stablecoin supplies accelerating the alt-season cycle.

Market Snapshot This Week:

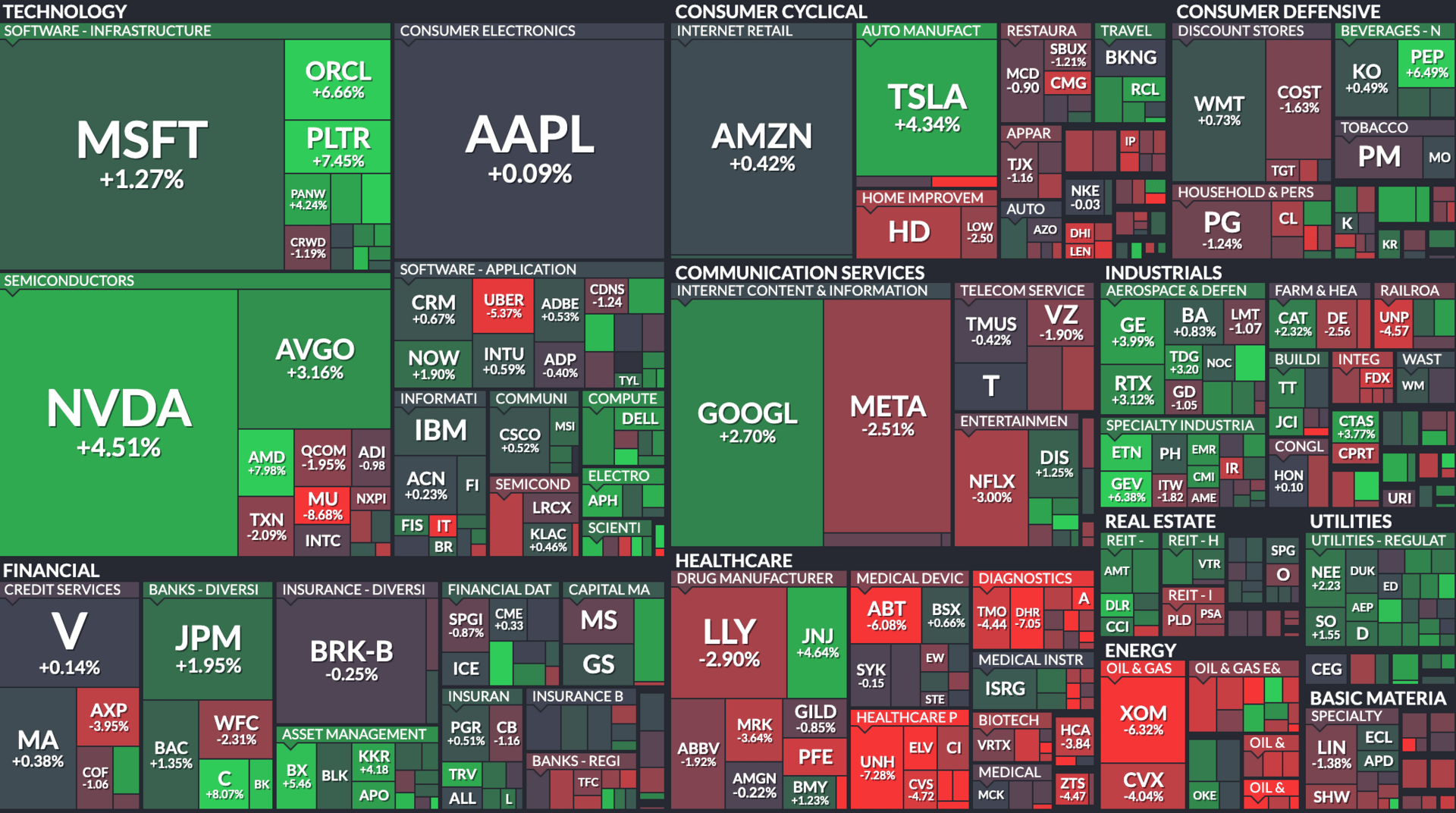

Semiconductors Surge Led by AMD and NVDA: AMD (+7.98%) and NVIDIA (+4.51%) saw major gains following reports of robust AI chip demand and supply chain improvements. AMD’s performance was buoyed by optimism around its next-gen AI accelerators, while NVIDIA continues to ride the AI data center boom. AVGO (+3.16%) also benefited from bullish sentiment in the chip sector.

Tech Infrastructure and Software Mixed, with Oracle and Palantir Up: Palantir (+7.45%) and Oracle (+6.66%) rallied on strong forward guidance and AI-related contracts, signaling enterprise demand for AI-driven data platforms. Conversely, Uber (-5.37%) fell sharply after disappointing margin forecasts, while Adobe (+0.53%) and Microsoft (+1.27%) showed more moderate gains.

Healthcare Weakness and Energy Selloff: UNH (-7.28%), LLY (-2.90%), and ABT (-6.08%) dragged down the healthcare sector amid concerns over Medicare reimbursements and regulatory pressures. Meanwhile, energy giants XOM (-6.32%) and CVX (-4.04%) declined on lower crude oil prices and weaker global demand outlooks.

All data current as of 1pm EST 07/18/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |