- Juniorstocks.com

- Posts

- Apple Secures Domestic Rare Earths, Nvidia’s China Comeback Ignites Tech Rally, Crypto Week Sends Bitcoin Over $120k

Apple Secures Domestic Rare Earths, Nvidia’s China Comeback Ignites Tech Rally, Crypto Week Sends Bitcoin Over $120k

You're receiving this newsletter as a subscriber to JuniorStocks.com. Join the conversation on our socials below.

Featured Article this week:

Apple inks $500M deal with MP Materials to secure domestic rare earth supplies, reducing dependence on China and advancing U.S. efforts to localize critical minerals vital for tech, defense, and green energy.

The partnership includes building a rare earth recycling facility in California, helping Apple push toward sustainability and closed-loop supply chains while MP Materials expands beyond mining into manufacturing and processing.

Backed by Apple, Wall Street, and the Pentagon, MP Materials is emerging as the centerpiece of America’s rare earth strategy, aiming to supply up to 15% of global demand by decade’s end as global rare earth competition intensifies.

Chinese Tech Firms Bounce on “Go Ahead” for Nvidia to Return to China

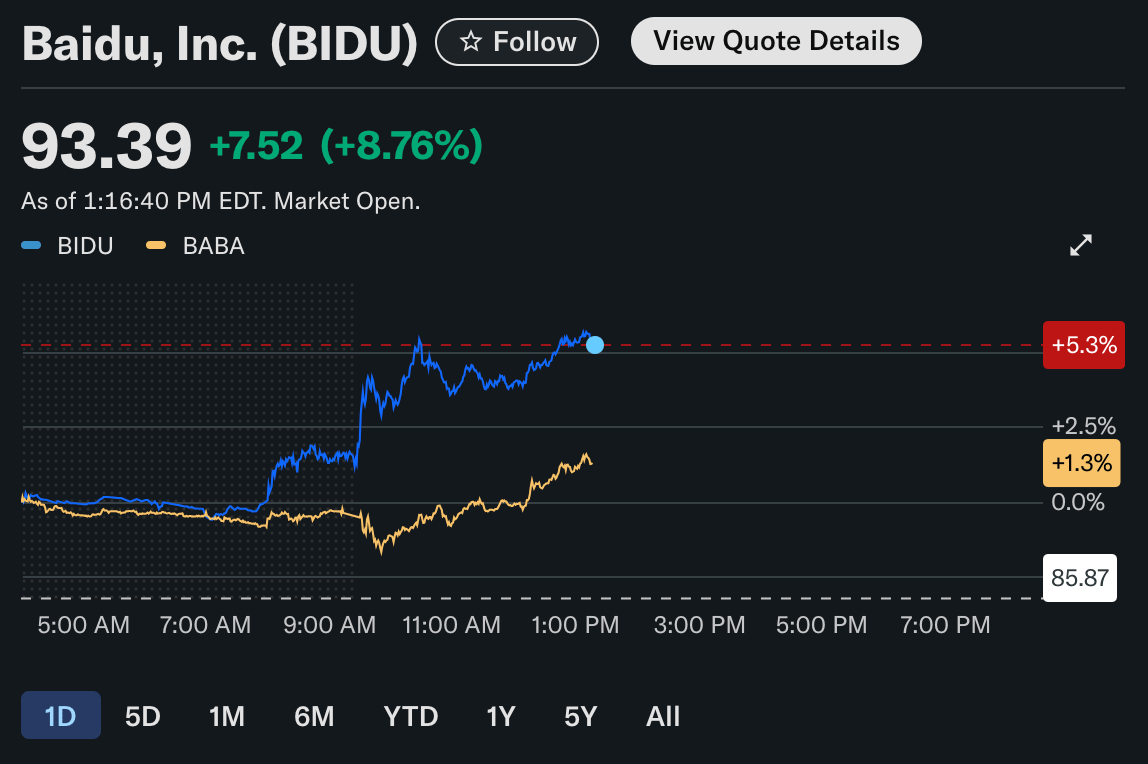

Shares surged on Nvidia’s China return: Alibaba and Baidu jumped 6.4% and 7.8%, respectively, after reports that Nvidia will resume sales of its H20 AI chips to China — a major development, as China accounted for up to 25% of Nvidia’s data center revenue in past quarters.

AI cloud expansion fuels demand: Baidu’s AI Cloud grew 42% YoY in Q1 2025, while Alibaba Cloud remains China’s leader, both investing heavily in generative AI — a market expected to reach over $50B in China by 2026.

Nvidia chips remain critical despite local efforts: Huawei’s Ascend chips gain traction, but most Chinese tech firms still favor Nvidia’s more powerful H20 GPUs for high-end AI workloads, maintaining Nvidia’s edge despite export restrictions.

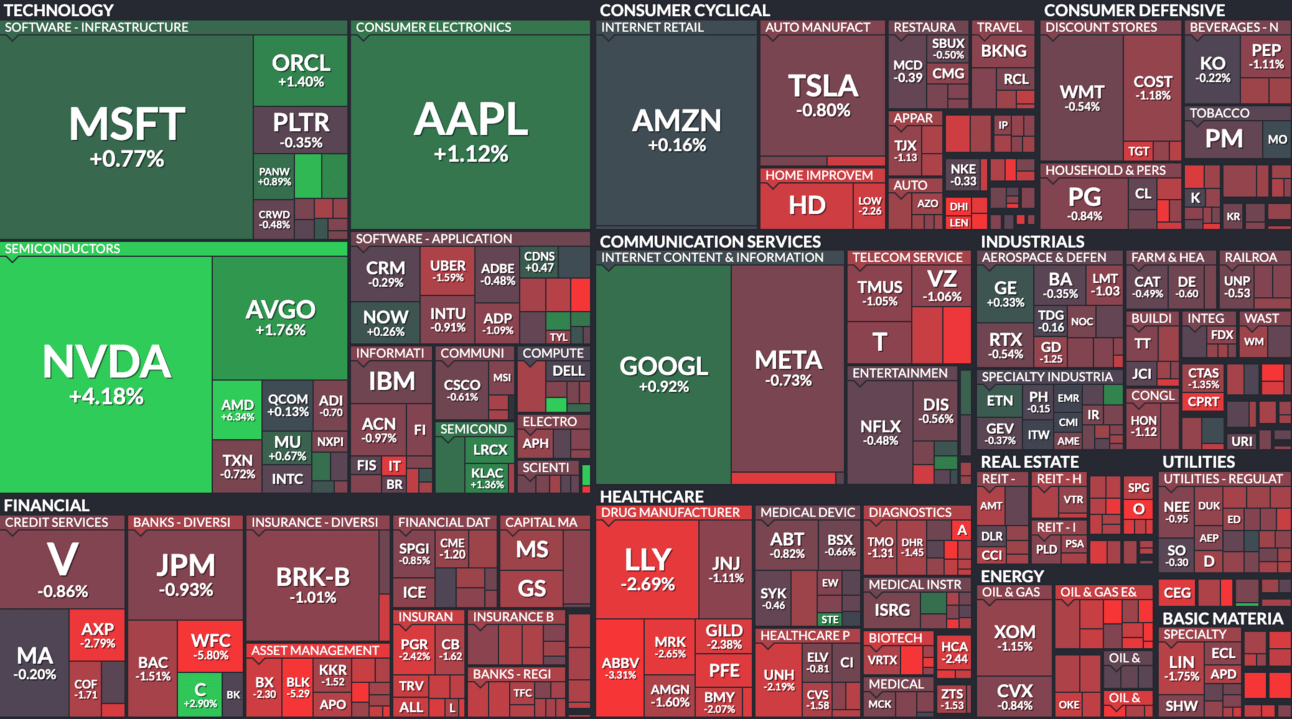

Market Snapshot This Week:

Semiconductors surged, led by Nvidia (+4.18%) and AMD (+6.34%), after reports confirmed Nvidia will resume AI chip sales to China, reigniting optimism about data center growth and easing supply chain fears.

Financials and healthcare sectors broadly declined, as rising bond yields and concerns over slowing consumer spending weighed on banks (WFC -5.80%, JPM -0.93%) and major drugmakers (LLY -2.69%, ABBV -3.31%).

Big Tech remained resilient overall, with Apple (+1.12%) and Alphabet (+0.92%) up on continued AI optimism, while Tesla (-0.80%) and Meta (-0.73%) slipped on profit-taking and softer consumer sentiment in discretionary spending.

All data current as of 1pm EST 07/15/2025

Top Viewed Articles this week:

We want your feedback on this week’s market insights! How’d we perform? 📈📉Let us know where we stand! 🚀 |